All About Systematic Withdrawal Plan (SWP)

A Systematic Withdrawal Plan (SWP) is a mutual fund facility allowing investors to withdraw a fixed amount from their investment regularly.

This method provides a steady income stream while keeping the remaining investment working for potential growth. SWP helps investors manage cash flow, optimize tax efficiency, and maintain financial discipline.

What is a Systematic Withdrawal Plan (SWP) in Mutual Funds?

A Systematic Withdrawal Plan (SWP) is a facility offered by mutual funds that allows investors to withdraw a fixed amount at regular intervals from their investment. Instead of redeeming the entire investment at once, SWP enables a gradual and structured withdrawal process, ensuring steady cash flow.

The withdrawals are made by redeeming mutual fund units at the prevailing Net Asset Value (NAV) on the selected date. Investors can customize the withdrawal frequency—weekly*, monthly, quarterly, or annually—based on preference. They also have the flexibility to withdraw a fixed amount or only the capital gains generated by the investment.

SWP continues as long as there are sufficient units in the fund. This method provides a disciplined approach to withdrawing funds while allowing the remaining investment to stay invested and grow over time. It is an efficient way to redeem investments without disrupting overall financial planning.

How does a Systematic Withdrawal Plan (SWP) work?

A Systematic Withdrawal Plan (SWP) allows investors to withdraw a fixed amount from their mutual fund regularly while keeping the remaining investment growing. This provides a steady cash flow without liquidating the entire investment. Here’s how it works

1. Investment Setup: The investor begins by investing a lump sum or utilizing existing mutual fund holdings to start the SWP.

2. Withdrawal Parameters: The investor decides the amount to withdraw, chooses the frequency (weekly, monthly, quarterly, etc.) and initiates the SWP.

3. Unit Redemption: On the withdrawal date, the mutual fund house sells several units to generate the required amount. The number of units redeemed depends on the fund’s Net Asset Value (NAV) at that time. If the NAV is high, fewer units are sold; if it is low, more units are redeemed.

4. Amount Transfer: The withdrawn amount is credited directly to the investor’s bank account.

5. Remaining Investment Growth: The remaining balance stays invested and continues to earn returns, potentially extending the longevity of the investment.

This process continues until the investor stops the SWP or the entire investment is exhausted. SWP offers a structured way to receive regular income while ensuring that a portion of the funds remains invested for future growth.

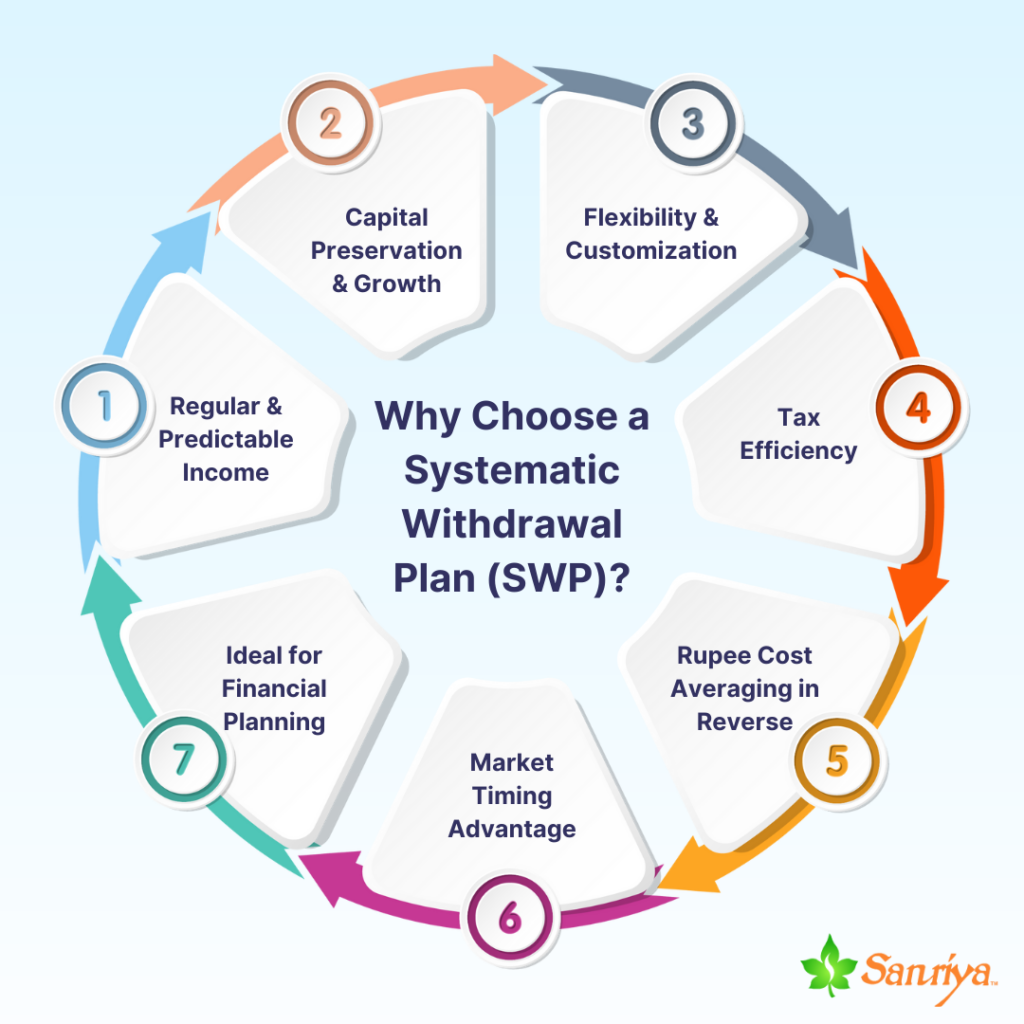

Why Choose a Systematic Withdrawal Plan (SWP)?

With tax efficiency, financial security, and disciplined investing, SWP is an excellent tool for managing income while preserving long-term wealth.

A Systematic Withdrawal Plan (SWP) is a strategic way to withdraw funds from your mutual fund investments while keeping the remaining corpus invested for potential growth. It offers financial stability, tax efficiency, and disciplined cash flow management. Here’s why SWP could be the right choice for you:

✅Steady Cash Flow : SWP ensures periodic income, which is ideal for retirees and individuals needing supplementary earnings.

✅Customizable Withdrawals : Investors can decide the amount and frequency (weekly*, monthly, quarterly, annually) based on their needs.

✅ Capital Preservation & Growth : The remaining investment stays invested, benefiting from market growth while allowing systematic withdrawals.

✅ Tax Benefits : SWP withdrawals are taxed only on capital gains, making them more tax-efficient than fixed deposits. No TDS is deducted.

✅ Rupee Cost Averaging Advantage : Withdrawals occur at varying NAVs, helping reduce the impact of market volatility.

✅No Market Timing Stress : Investors can avoid emotional decision-making and market timing risks, ensuring consistent financial stability.

Types of Systematic Withdrawal Plans (SWP)

SWPs offer different withdrawal options based on an investor’s financial goals and needs. Here are the main types:

1. Fixed Amount SWP: In this type, a specific amount is withdrawn periodically (monthly, quarterly, or annually), regardless of the investment’s performance. This ensures a steady income stream but may reduce the principal if the returns are lower than the withdrawal amount.

2. Appreciation SWP: Here, only the returns or appreciation on the investment are withdrawn, while the principal remains untouched. This method helps preserve capital, but the withdrawal amount may vary based on market performance.

3. Flexible SWP: Also known as Variable SWP, this option allows investors to modify the withdrawal amount based on their financial needs. It provides flexibility but requires active management to balance withdrawals and investment growth.

4. Perpetual SWP: Withdrawals continue indefinitely until the investor stops them or the investment corpus is exhausted. This type is helpful for long-term financial planning.

Each type of SWP serves different financial needs, offering investors flexibility and control over their withdrawals.

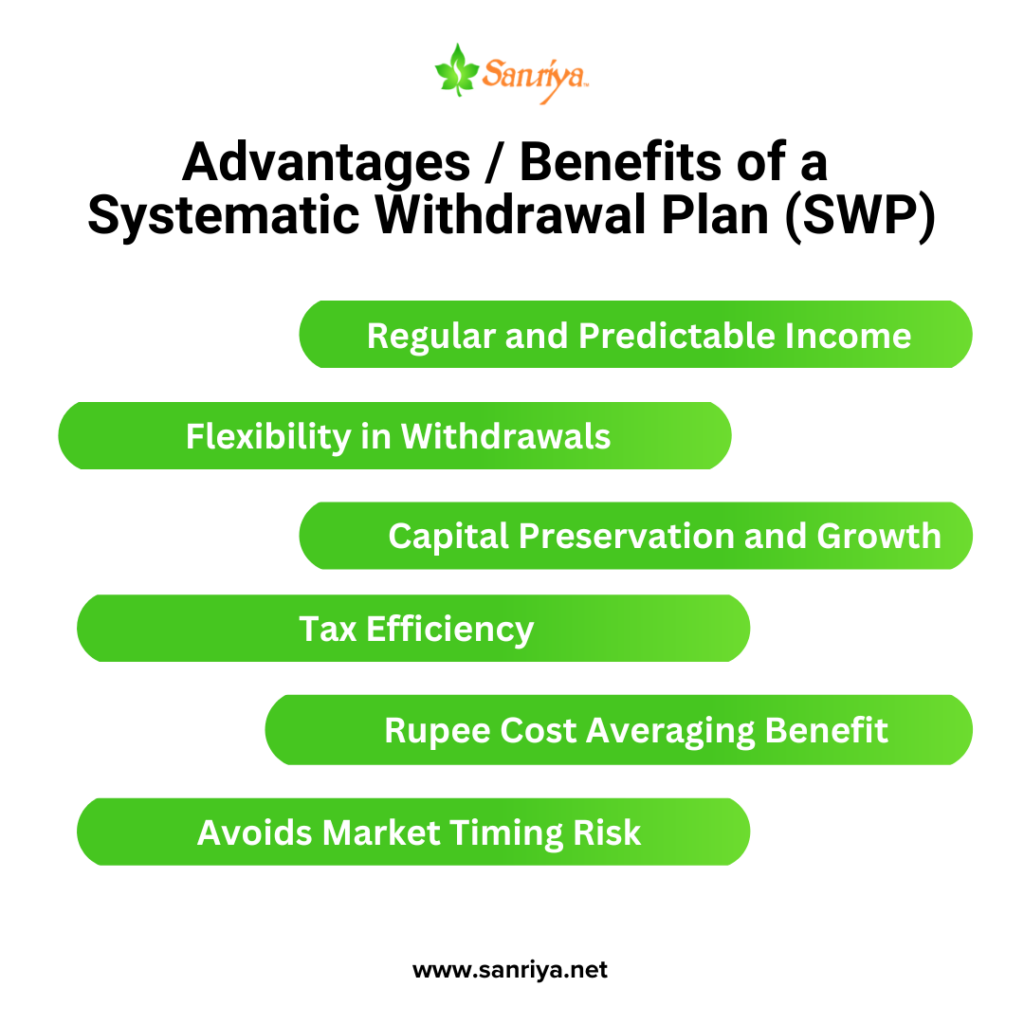

Advantages / Benefits of a Systematic Withdrawal Plan (SWP)

A Systematic Withdrawal Plan (SWP) offers a structured way to withdraw money from mutual fund investments while ensuring financial stability. It provides regular income, tax benefits, and flexibility, making it a preferred option for many investors. Here are the key benefits of SWP:

1. Regular and Predictable Income: SWP allows investors to receive a steady cash flow at fixed intervals. This is particularly beneficial for retirees or individuals needing supplementary income. It helps in managing daily expenses without relying on lump sum withdrawals.

2. Flexibility in Withdrawals: Investors can customize their withdrawal amounts and frequency (monthly, quarterly, or annually) as per their financial needs. This flexibility ensures that funds are available as required without disrupting the overall investment.

3. Capital Preservation and Growth: SWP allows periodic withdrawals while the remaining funds stay invested instead of withdrawing the entire investment. This helps preserve capital and allows for continued growth, maximizing returns over time.

4. Tax Efficiency: SWP withdrawals are considered a combination of the original investment and capital gains. Unlike fixed deposits, where interest is fully taxable, only capital gains from equity funds are taxed at lower rates, reducing tax liability. Additionally, there is no Tax Deducted at Source (TDS) on SWP withdrawals.

5. Rupee Cost Averaging Benefit: SWP helps manage market fluctuations by redeeming units at different price levels. This strategy averages out the sale price, minimizing the impact of market volatility and potentially enhancing overall returns.

6. Avoids Market Timing Risk: Investors don’t need to predict the best time to exit the market. SWP ensures disciplined withdrawals, eliminating the risk of making impulsive decisions based on market movements.

By offering financial security, tax advantages, and investment discipline, SWP is an effective way to generate steady income while maintaining long-term wealth growth.

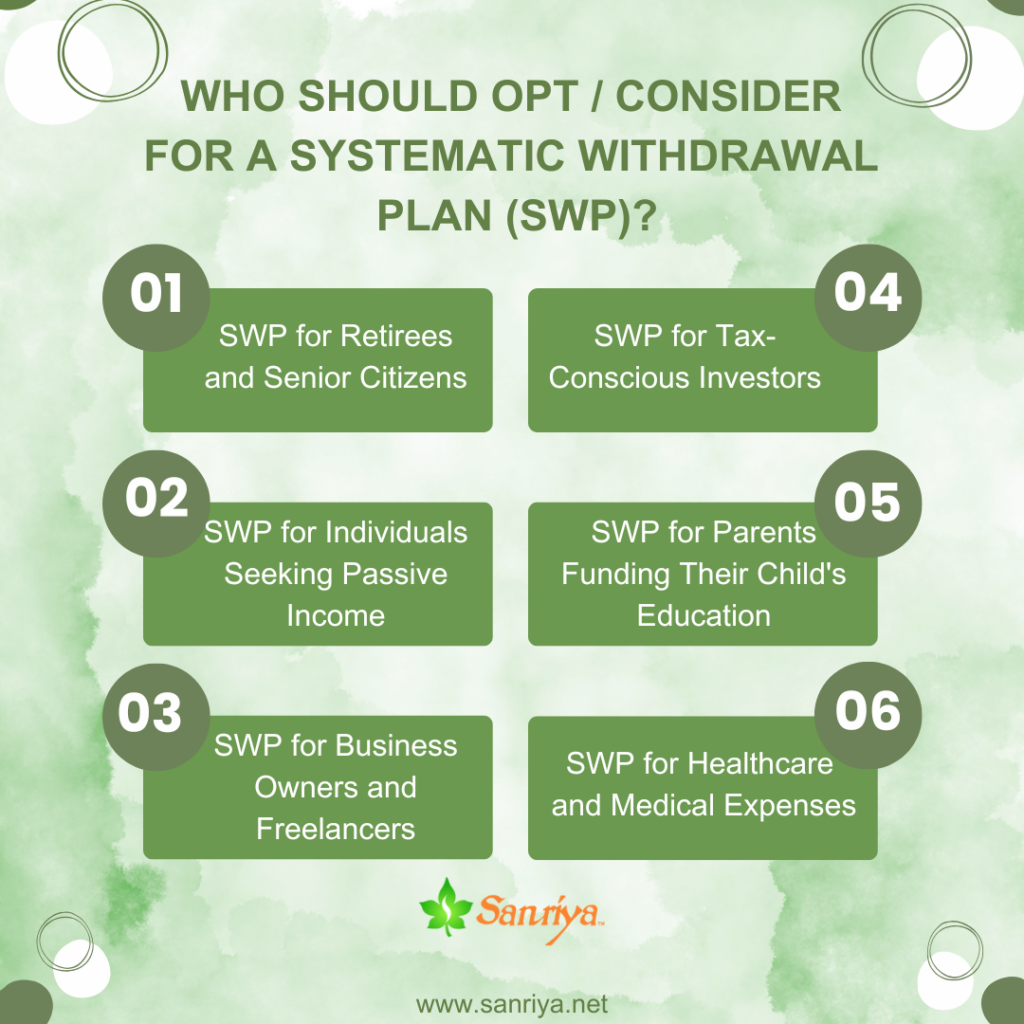

Who Should Opt / Consider for a Systematic Withdrawal Plan (SWP)?

A Systematic Withdrawal Plan (SWP) is ideal for individuals who need a structured way to withdraw money from their investments while keeping the remaining funds invested. It suits various financial needs and life situations, including:

1. SWP for Retirees and Senior Citizens: An excellent option for retirees who need a steady income without withdrawing their entire investment. It provides financial security while allowing their savings to last longer.

2. SWP for Individuals Seeking Passive Income: Ideal for those who rely on investments rather than a salary, offering a predictable cash flow while keeping funds invested for potential growth.

3. SWP for Business Owners and Freelancers: Helps people with irregular income streams maintain stable financial flow, covering personal expenses without the need for large lump-sum withdrawals.

4. SWP for Tax-Conscious Investors: Unlike fixed deposits, where interest is fully taxable, SWP is taxed only on capital gains, making it a tax-efficient option, especially for those in higher tax brackets.

5. SWP for Parents Funding Their Child’s Education: Instead of withdrawing a lump sum, parents can use SWP to systematically pay for school or college expenses over time, ensuring better financial planning.

6. SWP for Investors Transitioning to an Income-Focused Approach: Those who have built a significant investment corpus and now need regular income can benefit from controlled withdrawals while preserving capital.

7. SWP for Annual/Semi-Annual Funding for Vacations: Investors who want to fund periodic vacations without disrupting their primary investments can set up an SWP to withdraw a predetermined amount annually or semi-annually.

8. SWP for Insurance Premiums, Tax Payments, and Other Recurring Expenses: This can automate periodic payments like insurance premiums, tax liabilities, or other essential recurring obligations.

9. SWP for Birthday Gifts, Parties, Festivals, New Gadgets, and Charity: Helps individuals set aside funds for celebrations, buying new mobiles, TVs, vehicle servicing, or contributing to donations and charitable causes without financial strain.

10. SWP for Home Maintenance and Utility Bills: Ensures smooth payment of rent, electricity, water, internet, and other household expenses, reducing financial stress and maintaining uninterrupted services.

11. SWP for Healthcare and Medical Expenses: Covers recurring medical costs such as doctor consultations, medicines, health check-ups, and long-term treatments without relying on emergency savings.

12. SWP for EMIs and Loan Repayments: Helps manage home loans, car loans, or personal loan EMIs without disrupting monthly cash flow, ensuring timely payments and better credit management.

13. SWP for Gym Memberships, Club Fees, and Lifestyle Subscriptions: Funds recurring expenses like gym, fitness programs, club memberships, OTT platforms, and other lifestyle subscriptions without affecting primary income.

14. SWP for Children’s Extracurricular Activities: Supports expenses like sports coaching, music or dance classes, hobby lessons, or competitive exam coaching for children’s holistic development.

15. SWP for Pet Care and Maintenance: Helps pet owners cover recurring expenses like food, grooming, vet visits, and vaccinations without sudden financial strain.

Additionally, SWP helps investors maintain financial discipline by preventing impulsive withdrawals, ensuring a more structured and predictable approach to managing their savings.

Things to Consider Before Starting a SWP

Before setting up a Systematic Withdrawal Plan (SWP), assessing whether it aligns with your financial needs and investment strategy is essential. Here are key factors to consider:

1. Financial Goals & Income Needs: Determine if SWP fits your financial objectives—whether you need a regular income, want to cover specific expenses, or aim to preserve capital while generating returns. Accurately calculate your monthly expenses and future financial needs to decide the proper withdrawal amount and frequency.

2. Investment Horizon & Risk Tolerance: SWPs work best for long-term investors, allowing capital growth while ensuring periodic income. Understand your risk tolerance since withdrawals depend on Net Asset Value (NAV), meaning market fluctuations can affect the value of your remaining investment.

3. Fund Selection & Portfolio Diversification: Choose funds with stable returns and lower volatility, such as debt or balanced funds, for a predictable income stream. Avoid highly volatile funds if SWP is your primary income source. Ensure your investments are diversified to manage risk effectively.

4. Tax Implications: Tax on SWP withdrawals varies based on fund type and holding period. Equity funds held for over a year have a 12.5% tax on long-term capital gains exceeding ₹1.25 lakh, while debt funds are taxed as per your income slab, as per the FY 2024-25 Budget.

5. Withdrawal Sustainability & Market Conditions: A sustainable withdrawal rate (4%-6% annually) helps ensure long-term financial security. Since withdrawals are based on NAV, withdrawing too much in a declining market may deplete your capital faster.

6. Expense Ratios & Exit Loads: Check for exit loads on early withdrawals and compare fund expense ratios, as high costs can reduce overall returns.

Regularly reviewing your SWP and adjusting withdrawals as needed can help maintain financial stability while optimizing returns.

Systematic Withdrawal Plan (SWP) – A Smart Retirement Income Strategy

Why is SWP Important in Retirement? Will SWP help in Retirement?

Retirement marks the beginning of a new chapter where financial stability becomes essential. Unlike salaried individuals, retirees no longer have a fixed monthly income, making it crucial to have a structured withdrawal plan that ensures liquidity and long-term financial security. Without a proper strategy, there is a risk of exhausting savings too soon or being overly conservative, limiting lifestyle choices.

A Systematic Withdrawal Plan (SWP) offers a disciplined approach, allowing retirees to withdraw a fixed amount at regular intervals while keeping their remaining investments intact and growing. This method ensures financial independence by providing a steady and predictable cash flow to cover essential expenses like household needs, healthcare, and leisure activities.

Unlike traditional fixed-income options such as fixed deposits, which may deplete capital over time, an SWP allows the investment to continue earning returns, making savings last longer. It also offers the advantage of market-linked growth, helping retirees keep up with inflation. Retirees can adjust their withdrawals as needed, whether to accommodate unexpected medical expenses or reduce withdrawals during favourable market conditions.

By ensuring a reliable income stream while keeping funds invested for potential growth, SWP helps retirees enjoy financial security, peace of mind, and a worry-free retirement.

Benefits of SWP in Retirement

✔ Steady & Predictable Income : Ensures a reliable stream of cash flow to cover daily expenses, medical costs, and post-retirement lifestyle.

✔ Capital Growth & Longevity : The remaining corpus grows, helping sustain finances throughout Retirement.

✔ Tax Efficiency : Gains from SWP are taxed as capital gains, often making it more tax-efficient than pension schemes or annuities.

✔ Customizable Withdrawals : Allows retirees to adjust withdrawal amounts based on changing needs, ensuring financial security.

✔ Inflation-Adjusted Growth : Market-linked returns help retirees maintain purchasing power against inflation.

✔ Reduced Market Volatility Impact : Spreading withdrawals over time helps manage market fluctuations compared to lump-sum redemptions.

✔ Peace of Mind : No need to worry about running out of money early, as your corpus is strategically managed for longevity.

Example: How SWP Works for a Retiree

Meet Mr. Verma

Mr. Verma, a 60-year-old retiree, has ₹1 crore saved for his Retirement. He needs a steady monthly income of ₹50,000 to manage his household expenses, medical costs, and leisure activities, which amounts to ₹6 lakh per year. However, he doesn’t want to deplete his savings too quickly and prefers an option that allows his money to continue growing.

Instead of putting all his money into a fixed deposit (FD)—which may offer lower returns and higher tax implications—he decides to invest in a balanced mutual fund, expecting an average return of 9% per year. He sets up a Systematic Withdrawal Plan (SWP) to withdraw ₹50,000 per month, i.e. 6 lakh per year, while keeping the rest of his money invested.

Age |

Opening Balance |

Interest Earned |

Available Amount |

Withdrawal Amount |

Closing Balance |

| 61 | 1,00,00,000 | 9,00,000 | 1,09,00,000 | 6,00,000 | 1,03,00,000 |

| 62 | 1,03,00,000 | 9,27,000 | 1,12,27,000 | 6,00,000 | 1,06,27,000 |

| 63 | 1,06,27,000 | 9,56,430 | 1,15,83,430 | 6,00,000 | 1,09,83,430 |

| 64 | 1,09,83,430 | 9,88,509 | 1,19,71,939 | 6,00,000 | 1,13,71,939 |

| 65 | 1,13,71,939 | 10,23,474 | 1,23,95,413 | 6,00,000 | 1,17,95,413 |

| 66 | 1,17,95,413 | 10,61,587 | 1,28,57,000 | 6,00,000 | 1,22,57,000 |

| 67 | 1,22,57,000 | 11,03,130 | 1,33,60,130 | 6,00,000 | 1,27,60,130 |

| 68 | 1,27,60,130 | 11,48,412 | 1,39,08,542 | 6,00,000 | 1,33,08,542 |

| 69 | 1,33,08,542 | 11,97,769 | 1,45,06,311 | 6,00,000 | 1,39,06,311 |

| 70 | 1,39,06,311 | 12,51,568 | 1,51,57,879 | 6,00,000 | 1,45,57,879 |

| 71 | 1,45,57,879 | 13,10,209 | 1,58,68,088 | 6,00,000 | 1,52,68,088 |

| 72 | 1,52,68,088 | 13,74,128 | 1,66,42,216 | 6,00,000 | 1,60,42,216 |

| 73 | 1,60,42,216 | 14,43,799 | 1,74,86,015 | 6,00,000 | 1,68,86,015 |

| 74 | 1,68,86,015 | 15,19,741 | 1,84,05,757 | 6,00,000 | 1,78,05,757 |

| 75 | 1,78,05,757 | 16,02,518 | 1,94,08,275 | 6,00,000 | 1,88,08,275 |

| 76 | 1,88,08,275 | 16,92,745 | 2,05,01,020 | 6,00,000 | 1,99,01,020 |

| 77 | 1,99,01,020 | 17,91,092 | 2,16,92,111 | 6,00,000 | 2,10,92,111 |

| 78 | 2,10,92,111 | 18,98,290 | 2,29,90,401 | 6,00,000 | 2,23,90,401 |

| 79 | 2,23,90,401 | 20,15,136 | 2,44,05,538 | 6,00,000 | 2,38,05,538 |

| 80 | 2,38,05,538 | 21,42,498 | 2,59,48,036 | 6,00,000 | 2,53,48,036 |

Total |

₹ 2,73,48,036 |

|

₹ 1,20,00,000 |

₹ 2,53,48,036 |

|

After 20 years, Mr. Verma, now 80 years old, has withdrawn ₹50,000 per month, i.e. 6 lakh per year, for 20 years, totalling ₹1.2 crore. Despite these withdrawals, his investment has continued to grow, thanks to the power of compounding and market-linked returns. His corpus has increased from ₹1 crore to ₹2.53 crore, ensuring long-term financial security while providing him with a steady monthly income.

Unlike fixed deposits, where withdrawals gradually reduce the principal, SWP allows Mr Verma to maintain income and investment growth. This disciplined approach ensures financial independence, allowing him to enjoy Retirement without worries. With SWP, retirees can achieve stability, flexibility, and growth, making it a sustainable and efficient retirement strategy.

The above example is for illustration purposes only. The opening balance, closing balance, and available corpus may increase or deplete based on market conditions and investment performance. Investors should periodically review their SWP to ensure sustainability and align it with their financial goals.

Systematic Withdrawal Plan (SWP) – A Smart Strategy for Financial Goals

Why is SWP Important for Financing Goals?

Major financial commitments, such as a children’s education, recurring premiums like insurance, club and gym memberships, or online learning platforms, require regular payments. Managing these expenses while preserving wealth can be challenging, so a structured withdrawal strategy is essential. A Systematic Withdrawal Plan (SWP) provides a disciplined approach, ensuring a steady and predictable cash flow while keeping the remaining investment intact and growing.

Unlike fixed deposits that may erode capital over time, an SWP allows funds to continue earning returns while systematically withdrawing the required amount at regular intervals. This ensures that financial commitments are met without depleting savings too soon. Additionally, SWP provides flexibility, allowing withdrawal adjustments based on changing needs and inflation.

By ensuring a reliable income stream while maintaining long-term corpus growth, SWP helps families and individuals achieve their financial goals efficiently and without financial strain.

Benefits of SWP for Various Financial Goals

✔ Consistent Funding for Goals – Ideal for funding children’s education, EMI payments, insurance premiums, or other periodic financial obligations.

✔ Wealth Creation While Withdrawing – Even while making withdrawals, a significant portion of funds remains invested for future growth.

✔ Lower Tax Liability – Offers better post-tax returns than withdrawing from traditional savings instruments.

✔ Total Control Over Cash Flow – Investors can increase, reduce, or pause withdrawals based on their financial situation.

✔ Beats Inflation Over Time – Unlike traditional savings accounts, SWP investments generate returns that exceed inflation.

✔ Avoids Lump-Sum Withdrawals – Prevents the need for large one-time redemptions, helping manage liquidity without financial strain.

✔ Peace of Mind – Ensures funds are available when needed without financial stress or large lump-sum withdrawals.

Example: How SWP Works for Kids Higher Education Goal?

Meet Mr. Sharma

Mr. Sharma wants to fund his daughter’s higher education, which requires an annual expense of ₹2 lakh for five years. Instead of keeping his savings in a savings account, he decides to invest ₹10 lakh in a balanced mutual fund, expecting an average return of 9% per annum. He sets up an SWP to withdraw ₹2 lakh per year while allowing his investment to grow.

Year |

Opening Balance |

Interest Earned |

Total Available |

Withdrawal Amount |

Closing Balance |

| 01 | 10,00,000 | 90,000 | 10,90,000 | 2,00,000 | 8,90,000 |

| 02 | 8,90,000 | 80,100 | 9,70,100 | 2,00,000 | 7,70,100 |

| 03 | 7,70,100 | 69,309 | 8,39,409 | 2,00,000 | 6,39,409 |

| 04 | 6,39,409 | 57,547 | 6,96,956 | 2,00,000 | 4,96,956 |

| 05 | 4,96,956 | 44,726 | 5,41,682 | 2,00,000 | 3,41,682 |

Total |

₹ 3,41,682 |

₹ 10,00,000 |

|||

After five years, Mr Sharma has successfully withdrawn ₹10 lakh (₹2 lakh × 5) for his daughter’s education while his investment remains at ₹3.41 lakh, ensuring financial stability for future needs. Instead of depleting his savings, his money grows, making SWP a more sustainable and efficient education funding strategy.

This strategy allows Mr Sharma to cover his daughter’s education expenses without financial strain while keeping a portion of his investment intact. By opting for SWP, he ensures a steady cash flow without exhausting his savings. His remaining corpus of ₹3.41 lakh continues to grow, offering financial security for future needs. Unlike fixed deposits, where withdrawals reduce the principal, SWP provides liquidity and investment growth. This makes it a smarter and more efficient way to fund education expenses while preserving long-term financial stability.

The above example is for illustration purposes only. The opening balance, closing balance, and available corpus may increase or deplete based on market conditions and investment performance. Investors should periodically review their SWP to ensure sustainability and align it with their financial goals.

How to Maximize SWP Benefits

Why is SWP Important for Financing Goals?

✅ Begin with a Strong Investment Base – Invest a suitable lump sum or build a substantial corpus through SIP in a mutual fund that aligns with your financial goals and risk tolerance before initiating the SWP.

✅ Choose the Right Withdrawal Amount – Keep your withdrawal rate sustainable (typically 4%-6% annually) to ensure your capital lasts longer while continuing to grow.

✅ Align SWP with Financial Goals – Use SWP to fund Retirement, monthly expenses, child’s education, or any other financial needs while keeping your principal invested.

✅ Monitor and Adjust as Needed – Regularly review your SWP to adjust withdrawal amounts based on market conditions and personal financial requirements.

✅ Stay Invested for Long-Term Growth – A well-planned SWP strategy ensures steady cash flow while allowing the remaining corpus to grow through compounding.

✅ Opt for Tax-Efficient Withdrawals – Withdrawals from equity funds after one year are subject to lower long-term capital gains tax (12.5% on gains above ₹1.25 lakh, as per FY 2024-25 Income Tax), making SWP more tax-efficient than traditional fixed-income options.

✅ Select the Right Fund Type – Consider using debt or balanced funds for stable income and equity funds for long-term growth with occasional withdrawals.

Choosing the Right SWP Advisor / MFD / RIA

✔ Understand Your Goals – A good advisor / MFD / RIA will assess your financial needs, risk tolerance, and income requirements before recommending an SWP strategy.

✔ Personalized Approach – Work with an advisor / MFD / Registered Investment Advisor who offers customized withdrawal strategies rather than a generic one-size-fits-all approach.

✔ Experience & Credentials – Choose an advisor / MFD / Registered Investment Advisor with SEBI or AMFI certification and a strong background in investment planning.

✔ Reputation & Reviews – Check client testimonials, seek recommendations, and research their expertise before making a decision.

✔ Ongoing Support & Monitoring – A reliable advisor / Mutual Fund Distributor / Registered Investment Advisor should provide regular performance updates and suggest adjustments to optimize your SWP.

Seamless Systematic Withdrawal Plans (SWPs) with Sanriya Finvest

At Sanriya Finvest, we are committed to providing you with a hassle-free and strategic approach to managing your investments. Our Systematic Withdrawal Plan (SWP) services help you withdraw a fixed amount regularly while keeping your capital invested for continued growth.

We offer SWP solutions across all Asset Management Companies (AMCs) in India, ensuring flexibility, tax efficiency, and financial stability for our clients.

You can conveniently set up an SWP with the following AMCs through us:

✅ Aditya Birla Sun Life Mutual Fund SWP plan

✅ Angel One Mutual Fund SWP plan

✅ Axis Mutual Fund SWP plan

✅ Bajaj Finserv Mutual Fund SWP plan

✅ Bandhan Mutual Fund SWP plan

✅ Bank of India Mutual Fund SWP plan

✅ Baroda BNP Paribas Mutual Fund SWP plan

✅ Canara Robeco Mutual Fund SWP plan

✅ DSP Mutual Fund SWP plan

✅ Edelweiss Mutual Fund SWP plan

✅ Franklin Templeton Mutual Fund SWP plan

✅ Groww Mutual Fund SWP plan

✅ HDFC Mutual Fund SWP plan

✅ Helios Mutual Fund SWP plan

✅ HSBC Mutual Fund SWP plan

✅ ICICI Prudential Mutual Fund SWP plan

✅ IL&FS Mutual Fund (IDF) SWP plan

✅ Invesco Mutual Fund SWP plan

✅ ITI Mutual Fund SWP plan

✅ JM Financial Mutual Fund SWP plan

✅ Kotak Mahindra Mutual Fund SWP plan

✅ LIC Mutual Fund SWP plan

✅ Mahindra Manulife Mutual Fund SWP plan

✅ Mirae Asset Mutual Fund SWP plan

✅ Motilal Oswal Mutual Fund SWP plan

✅ Navi Mutual Fund SWP plan

✅ Nippon India Mutual Fund SWP plan

✅ NJ Mutual Fund SWP plan

✅ Old Bridge Mutual Fund SWP plan

✅ PGIM India Mutual Fund SWP plan

✅ PPFAS Mutual Fund SWP plan

✅ quant Mutual Fund SWP plan

✅ Quantum Mutual Fund SWP plan

✅ Samco Mutual Fund SWP plan

✅ SBI Mutual Fund SWP plan

✅ Shriram Mutual Fund SWP plan

✅ Sundaram Mutual Fund SWP plan

✅ Tata Mutual Fund SWP plan

✅ Taurus Mutual Fund SWP plan

✅ Trust Mutual Fund SWP plan

✅ Unifi Mutual Fund SWP plan

✅ Union Mutual Fund SWP plan

✅ UTI Mutual Fund SWP plan

✅ WhiteOak Capital Mutual Fund SWP plan

✅ Zerodha Mutual Fund SWP plan

✅ 360 ONE Mutual Fund (Formerly Known as IIFL Mutual Fund) SWP plan

Start Your SWP Today!

Ensure financial stability and a steady income with a disciplined withdrawal strategy. Contact Sanriya Finvest today to set up your SWP and maximize your investments!

Frequently Asked Questions (FAQs) on Systematic Withdrawal Plan (SWP)

SWP allows investors to withdraw a fixed amount periodically from their mutual fund investment, providing regular cash flow. SIP enables investors to invest a fixed amount regularly, helping with disciplined wealth accumulation.

SWP ensures timely payments for recurring expenses such as insurance premiums, EMIs, and taxes while keeping funds invested for growth. It also covers club memberships, subscriptions, pet care, and home maintenance.

SWP for Retirement, SWP for Higher Education, SWP Advisor Pune, SWP MFD Pune, SWP RIA Pune, SWP Services Pune, SWP Consultant Pune, SWP Broker Pune

Looking to deepen your knowledge of SWP? Explore our valuable resources for insights on benefits, strategies, and smart investment approaches. Learn how to make the most of your investments with expert tips and guidance. Stay informed and invest wisely!

1) How Does Tax Work for SIP, STP, and SWP?

2) What is an SWP, and when should you use it?