“What People think about Real Estate?”

People would buy land / property / flat / real estate and sell or rent it for profit. Even after the banks and other investment avenues, most individuals still prefer to invest in property to earn a regular income and create wealth. You start earning rental income every month if you invest in a property and rent it out. After 10 or 15 years, the price would have increased when you sell the property, providing you a lump sum pay out. Today, loan accessibility and affordability have made owning property convenient for individuals. As a outcome, real estate is now an asset class for the masses, which used to be an asset class for the classes.

“What People think about Fixed Deposit?”

A bank mainly accepts deposits at a particular interest rate from its customers and provides loans at relatively higher rates to potential borrowers, earning them the margin. Bank does not invest its own money. It takes money from customers with fixed deposits and offers it to borrowers. Over time, fixed deposits became for many individuals a preferred investment choice as they were easy and the bank guaranteed returns. Fixed deposits provide you with the convenience of an assured return, but those yields are minimal and also generally fall below inflation rates.

Calculations for 2 situations are given in the table below where someone invests in a flat and a fixed deposit.

Many of us think that investing in real estate and property is a sure shot cash doubling method in which you can double your investment in a couple of years as demand for real estate is increasing more than ever before and individuals have a lot of disposable income. To find out which one is better, let’s do a small assessment. Investing the money in FD / RD or buying a property by taking a loan.

Few assumptions:

1] For investment purposes, a ready possession flat is brought on loan and will be sold at double the purchase price after 5 years.

2] ₹. 1 Cr Flat Cost. (₹ 20 Lakhs down payment and 80 Lakhs loan)

3] Flat given on rent. Every year, flat price and rent increased by 5%

4] The flat is sold at twice the price, i.e., after five years at ₹ 2 Cr.

5] Then compare the returns with another scenario where somebody invests the same amount as the down payment, the registration fee, the stamp duty amount in a fixed deposit and the EMI payments in a recurring deposit.

6] It shows that the post-tax returns at the end of five years demonstrate better yields from the second situation (of FD / RD).

| WHEN A PROPERTY BOUGHT BY TAKING LOAN |

| ASSUMPTIONS |

| ● Cost of Flat |

₹ 1,00,00,000 |

| ● Down Payment (20% of Flat Cost) |

₹ 20,00,000 |

| ● Loan Amount (80% of Flat Cost) |

₹ 80,00,000 |

| ● Rate of Interest : |

9% |

| ● Expected monthly rental income (3% of flat value) |

₹ 25,000 |

| ● Rent Increase Every Year by |

5% |

| ● Investor’s Tax Bracket |

30% |

| ● Sale Price of the flat (after 5 years) |

₹ 2,00,00,000 |

| OUTFLOW OF MONEY |

| ● Upfront (Down Payment) |

₹ 20,00,000 |

| ● Stamp Duty & Registration (Approx. at 6%) |

₹ 6,00,000 |

| ● EMI @ 9% for 20 Years Loan |

₹ 71,978 |

| ● Total EMI outflow over 5 years |

₹ 43,18,685 |

| ● Principal Repaid 5 years |

₹ 9,03,436 |

| ● Balance to repay |

₹ 70,96,564 |

RETURNS ON FLAT / PROPERTY

|

WHEN MONEY IS INVESTED IN FD / RD |

| |

If all the assumptions hold good, the amount of money one would have made from this real estate investment after 5 years, net of taxes, is as follows: |

|

Instead of buying property, if the investor had kept the initial down payment & stamp duty amount of ₹ 26,00,000 in an FD @ interest Rate 8% and had opened a RD for the EMI of ₹ 71,978 for 60 months @ 7.2%, the amount that would have accumulated: |

|

| A |

● Gross inflow ( Sale of flat) |

₹ 2,00,00,000 |

A |

● Initial amount |

₹ 26,00,000 |

|

| B |

● Upfront Payment & stamp duty |

₹ 26,00,000 |

B |

● Interest earned on initial amount @ 8% p.a. |

₹ 12,20,253 |

|

| C |

● Rental Income (60 Months) (with 5% annual increase in rental) |

₹ 16,57,689 |

C |

● RD principal in 5 years on EMI of ₹. 71,978p.m. |

₹ 43,18,685 |

|

| D |

● Tax on rental income (after all deductions) |

₹ 3,31,538 |

D |

● RD Interest earned on EMIs in 5 years @ 7.2% p.a. |

₹ 8,92,278 |

|

| E |

● Capital Gain Tax @ 20% (assumed indexation of past 5 years) |

₹ 8,12,248 |

E |

● Tax on interest income @30% |

₹ 6,33,759 |

|

| F |

● Repayment of principal |

₹ 70,96,564 |

|

● Net inflow after 5 years [a+b+c+d-e] |

₹ 83,97,456 |

|

| G |

● EMI Paid in 60 of months |

₹ 43,18,685 |

|

The difference in cash flow between the FD / RD investment and the leveraging of real estate investment is nearly ₹ 15,98,801

|

|

| |

○ Principal |

₹ 9,03,436 |

|

|

| |

○ Interest |

₹ 34,15,249 |

|

|

| H |

● Tax saving on Interest Paid (Max Rs. 2 Lakh deduction on let out property) @ 30% |

₹ 3,00,000

|

|

The investment in FDs and RDs is tax inefficient and conservative. The total money inflow will definitely improve significantly if we plug in greater yields or tax-efficient returns. Builders and housing finance companies are the only members who would make money rather than you.

|

|

| |

● The inflow after 5 years. (a-b+c-d-e-f-g+h) |

₹ 67,98,655

|

|

|

So we can obviously see in purely financial terms that investing in FDs / RDs gives nearly ₹. 16 Lakhs higher returns than property. (Average diversified MFs returns for same periods are 12% CAGR. )

|

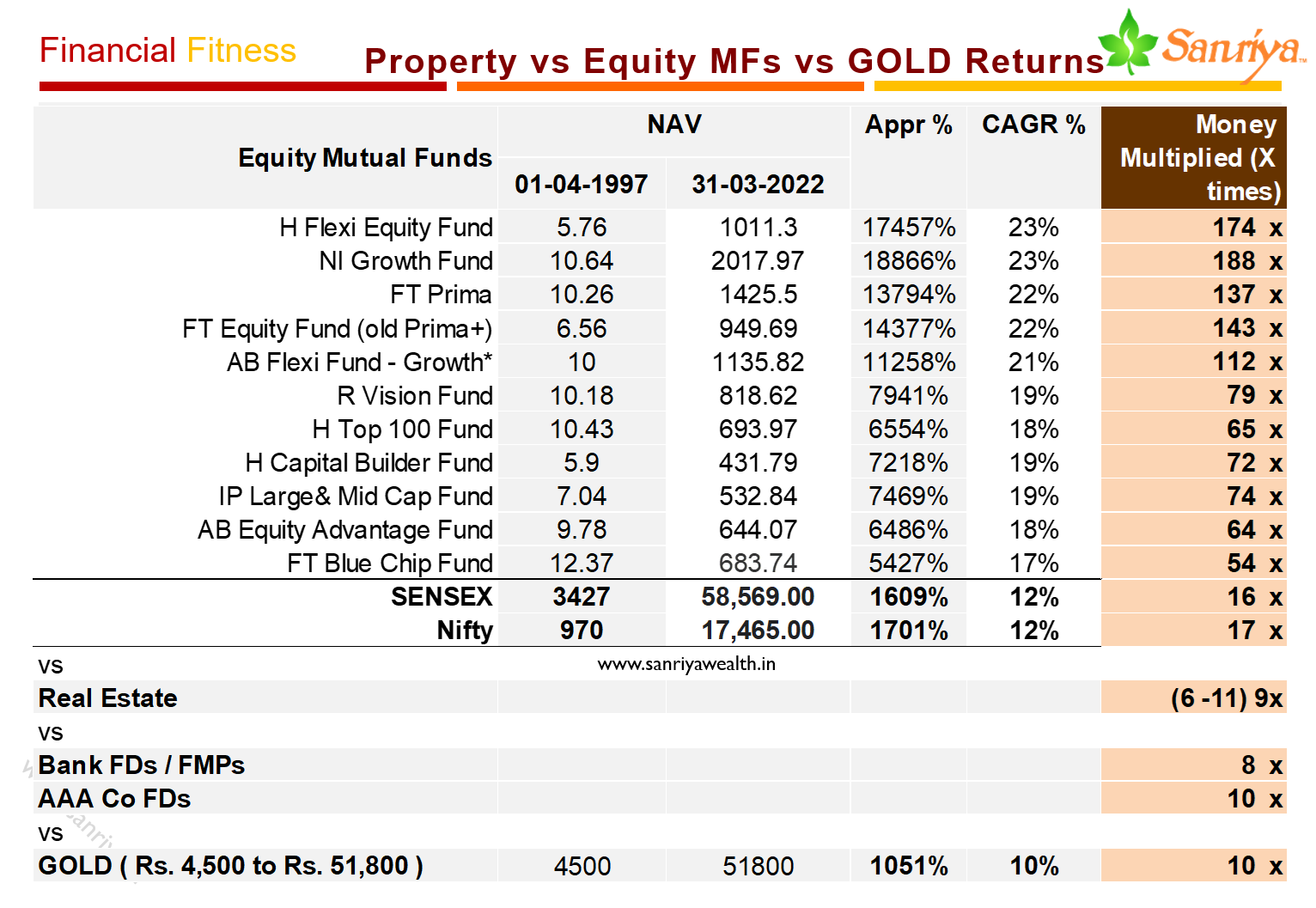

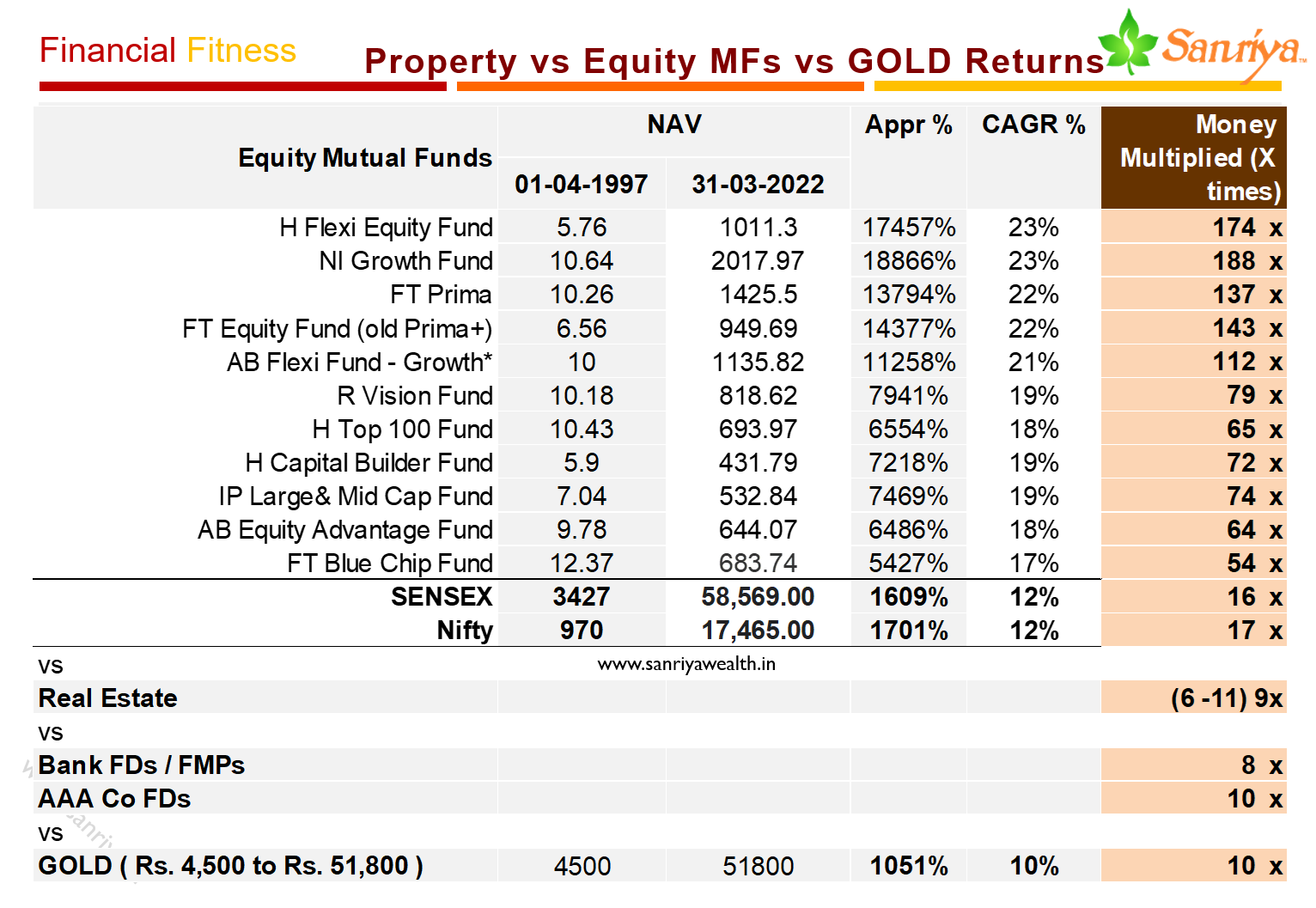

Which is the best investment to make in the long term? Property, fixed deposit, Stocks (equity) or direct equity through mutual funds?

Short reply: Equity (through Mutual Funds or directly stocks if you are expert). “I got wealthy by investing in FDs and by buying insurance policies ,”– no one ever said.

Long reply? Read on.

What People think about Equity Mutual Fund (Stock Market)?

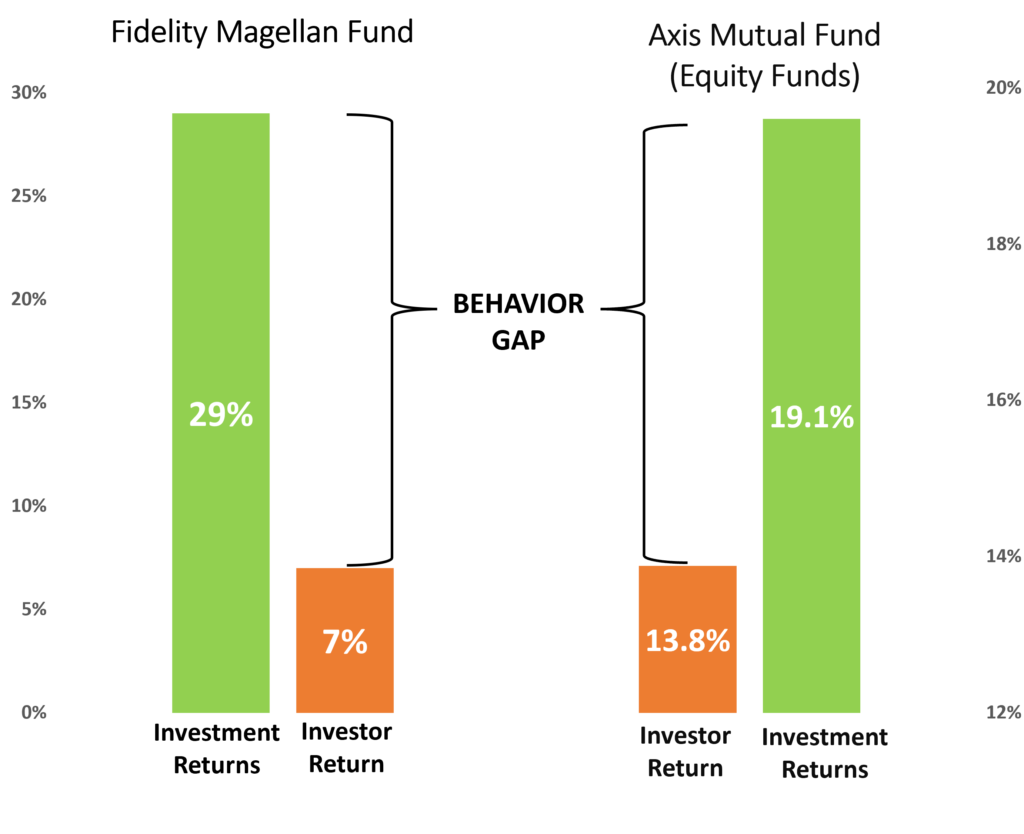

Many of us have often thought we’d rather get ‘ lower but safer ‘ returns from FDs than higher but volatile returns from equity mutual funds. If we invest on this basis, two significant points will be overlooked. 1] Equity markets are less long-term volatile and return are much higher than FDs or even real estate (and equity mutual funds make investing in stock markets very easy for individuals). 2 ] The returns we receive from FDs do not add wealth because inflation is nullified.

Investing in equity has generated an average annualized return of 16%. Short-term equity markets are certainly volatile (risky) – they have delivered +81% for one year and down -52% for another year, but they become less volatile over longer time horizons (and generate higher returns).

Equity returns are always over and above the inflation rate, i.e. 7.85% annualized over the past 40 years on average. Unfortunately, when we look at returns on our investments, inflation is a truth that we do not consider. We look at isolated returns and they often seem better than they really are worth. The lowest is fixed deposits (FDs) that are only 6.5% to 8% pa (but without volatility).

Basically real estate delivers only about 5 to 7% returns. (otherwise the Ambani’s, Tata’s, Birla’s, India’s Kotak’s of India would have had all their money in real estate rather than invested in businesses.)

Investing in mutual funds for wealth creation is a much better instrument. If long-term financial goals require you to play it safely despite minimal returns, then stick to debt mutual funds. However, if the creation of wealth is on your radar, it is necessary to invest in equity mutual funds. One of the most common investment vehicles since time immemorial was fixed deposit, property, equity. They are very distinct, however, and meet distinct investor requirements, whether you are planning a short-term or long-term investment.

Your portfolio of investments should be a nice blend of investments in debt (FD type / fixed income / low risk) and equity (medium risk). Low-risk investments, however, generally provide stability and guaranteed returns. Investing in fixed deposits, property, mutual funds (equity) therefore has its own benefits and disadvantages. Therefore, before you begin looking at investment options, you must ensure that you work on your goals and financial plan.

Remember, as an investor, you need to spend some time evaluating your financial targets, risk preference, and time horizon. These three variables will assist you to determine the assets you can invest in and meet your goals. Talk to an investment advisor and take his help to creation of an investment plan. Your financial independence is dependent on how efficiently you create and implement your financial plan.

Reasons Not To Invest In Real Estate / Flat / Property:

There are few primary reasons why intelligent investors should avoid investing in flat / property:

♦ No Assured Returns: An unforeseeable property return (price). (The price will be decided by the buyer). Many individuals think there is always a increase in estate prices.

♦ Price will skyrocket or fall just because of the place of the property, building quality, which makes the property an unexpected asset class. There may be downs on the estate market. In 1995, prices in Mumbai, Hyderabad, Delhi and other towns were corrected for up to 45% for 10 years. It depends on a number of factors. If the markets are declining, then you may have to wait a little longer.

♦ An asset class under performance: most properties generate more or less the same returns over a period as Fixed Deposit.

♦ Most of the illiquid assets are property. Real Estate is the market of a buyer when you need money as a matter of urgency and finding a buyer is not simple. Usually an urgent sale gets much less than the asset’s true value. Price is negotiated with a lot of legal hassle like vegetable.

♦ It has hardly beat inflation

♦ Offer an annual rent between 2% to 3% of the total value of property – less than the returns on an FD and less than the EMI payments.

♦ 100% Occupancy is not ensured (by landlord).

♦ Investors who blindly believe in real estate tend to recognize only windfall gains stories

♦ Real Estate is a category of emotionally charged assets, as owners tend to connect properties to memories and feelings such as births, weddings, deaths, etc., which is why most investors forget about unnoticed return on investment.

♦ Investors may face endless litigation for many reasons, such as family conflicts, tenant encroachment or anti-social aspects, a government entity seeking property for a public project, government record ambiguity, etc.

♦ High maintenance efforts to maintain house in order. You have to pay taxes and utility bills, keep it in good condition, and also find fresh tenants when and when necessary. It needs time and energy at all times. Many people believe that investing in real estate is a lifelong expense.

♦ Property performance monitoring has many challenges. In Mutual Funds, you can monitor their output on a regular basis by clicking a button. But if you own 5 properties, can you check them physically every day?

♦ Alterations, Changes, value-addition does not produce returns, an investor may add equipment, interior decoration and gadgets to improve the experience of living in a property, but the next investor may want to customize the property differently and will therefore not be willing to compensate the seller for the additional investments made.

♦ Buyers and sellers often can’t agree on even Vaastu

♦ Even for small issues with society or neighbors, you can’t change home anytime. You can’t change your home anytime you want to move to another town for better employment. Even if you want to manage the traffic from one location to another, you can not change home at any moment. You can’t change your home anytime, even if you need a family from 2 BHK to 3 BHK etc.

♦ You can not change your flat at any moment, even if your tax benefits decreases, (like the principal’s 80C and interest’s 24(b).) You can’t change home whenever a new cosmopolitan area comes in the town that’s better than where you’re staying now. If you move out of town, it’s a issue to find a tenant. A tenant who can turn your dream home into a dirty home, and so on.

Disclaimers: This subject is solely from a financial / investment point of perspective. We won’t take in any psychological or emotional elements. And ultimately it’s up to you to decide what’s better. Mutual funds and securities investments are subject to market risks and there is no assurance or guarantee that the objectives of the Scheme will be achieved. Past performance of the Sponsor/ Mutual Fund/ Investment Manager are not indicative of the future performance of the Scheme(s)

Fixed Deposits Vs. Real Estate Investment, Which Is The Best Investment Option – Stock Markets, Mutual Funds, Real Estate Or Fixed Deposits?, Real Estate Investing Vs Fixed Deposit, Big Reasons Not To Invest In Real Estate, Why Smart Investors Should Avoid Investing In Real Estate, REASONS WHY YOU SHOULD CHOOSE EQUITY OVER FD, GOLD & REAL ESTATE, Which Is The Best Investment Option? Mutual funds vs Stock Markets Vs Real Estate Vs Fixed Deposits, Which Is Better : Investing In Real Estate Or gold, Which Is Better : Investing In Real Estate Or fixed deposit, Which Is Better : Investing In Real Estate Or mutual funds, Which Is Better : Investing In Real Estate Or Fd, Fixed Deposit Vs Real Estate Based On Current Market, Investing In Property Vs Investing In Equity: Which Gives Higher Returns?, Which is the best long-term investment to make? Property, Fixed Deposit, Equity though Mutual Funds or direct stocks?, FIXED DEPOSIT vs Flat investment, FIXED DEPOSIT vs Property investment, FIXED DEPOSIT vs Real Estate, FIXED DEPOSIT vs Mutual Funds, FIXED DEPOSIT vs Stocks, Mutual funds Vs. Real Estate Investment, Which Is The Best Investment Option – Stock Markets, Mutual Funds, Real Estate Or Mutual funds?, Real Estate Investing Vs Mutual fund, Big Reasons Not To Invest In Real Estate, Why Smart Investors Should Avoid Investing In Real Estate, Reasons Why You Should Choose Equity Over Fd, Reasons Why You Should Choose Equity Over Fixed deposit, Gold & Real Estate, Which Is The Best Investment Option? Stock Markets Vs Real Estate Vs Mutual funds, Which Is Better : Investing In Real Estate Or Fixed deposit?, Mutual fund Vs Real Estate Based On Current Market, Investing In Property Vs Investing In Equity: Which Gives Higher Returns?, Which Is The Best Long-Term Investment To Make? Property, Mutual fund, Equity Though Mutual Funds Or Direct Stocks?, Mutual fund Vs Flat Investment, Mutual fund Vs Property Investment, Mutual fund Vs Real Estate, Mutual fund Vs Stocks investment, Buying a property by taking a loan Vs investing the money in FD/RD, Buying a flat by taking a loan Vs investing the money in FD/RD, Buying a home by taking a loan Vs investing the money in FD/RD, making fd is better than taking flat on loan, earn more on fd than taking flat on loan, earn more returns on fd than flat, earn more returns on fd than real estate, earn more returns on fd than property, making fixed deposit is better than taking flat on loan, earn more on fixed deposit than taking flat on loan, earn more returns on fixed deposit than flat, earn more returns on fixed deposit than real estate, earn more returns on fixed deposit than property,