A systematic investment plan (SIP) regularly invests a fixed amount in mutual funds, typically monthly. SIP allows investors to invest consistently, regardless of market conditions, making it easier to build wealth over time without the stress of market timing.

Key Features of SIP:

- Discipline: SIP encourages regular saving and investing, ensuring consistent growth of wealth over time.

- Affordability: Investors can start with a small amount (as low as ₹500, depending on the fund), making it accessible for people with different budgets.

- Compounding: With SIP, returns earned on investments are reinvested, helping you take advantage of compounding and grow your wealth faster.

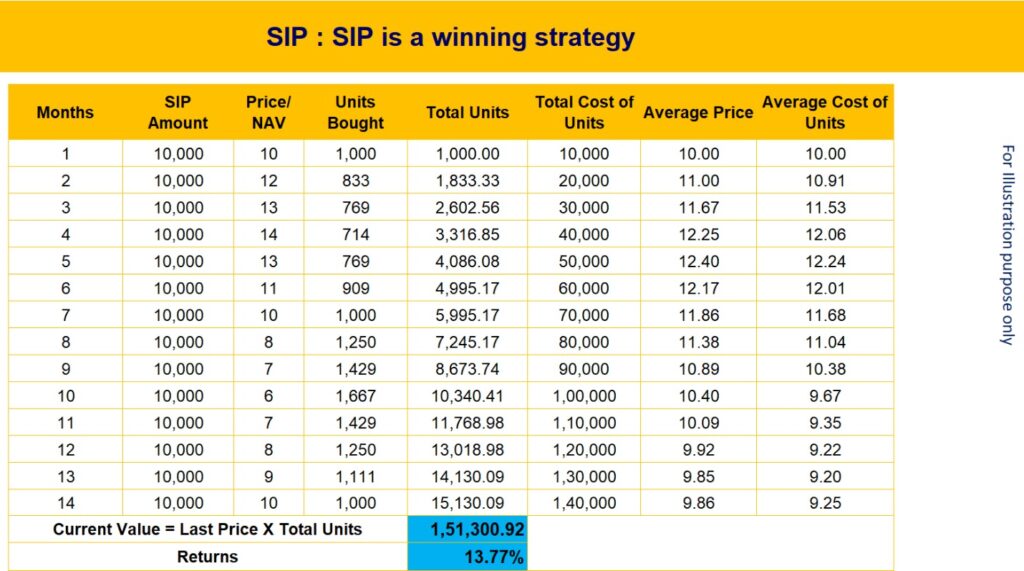

- Dollar-Cost Averaging: SIP allows you to buy more units when the market is low and fewer units when the market is high, averaging the purchase cost over time.

- Flexibility: You can adjust your SIP amount, increase or decrease it, or switch between funds based on your financial goals and market conditions.

- Long-Term Wealth Creation: SIP is ideal for long-term financial goals such as retirement or education, as it benefits from the power of compounding and long-term market growth.

- Automatic Debits: SIPs are automatically deducted from your bank account on a set date, making it convenient and eliminating the risk of missing a payment.

- Reduced Emotional Decision-Making: SIP helps you avoid making impulsive investment decisions during market ups and downs by keeping you focused on long-term goals.

A Systematic Investment Plan (SIP) enables investors to invest a fixed amount in mutual funds at regular intervals, fostering disciplined investing and leveraging the power of compounding to build wealth over time, as shown below.

In conclusion, SIPs offer a disciplined and convenient way to build wealth over time, making them ideal for long-term goals like retirement or education. They help investors avoid the stress of market timing and take advantage of compounding and diversification. However, choosing the right mutual fund and SIP strategy can be challenging without expert advice.

A Systematic Investment Plan (SIP) is a smart approach to goal-based investing, helping you build wealth through regular contributions. Whether you’re saving for retirement, a child education investment plan, or emergency fund planning, SIPs offer long-term benefits. A mutual fund distributor or advisor can help design personalized strategies tailored to your financial goals. They use proven wealth creation methods and offer financial planning services.

![]()