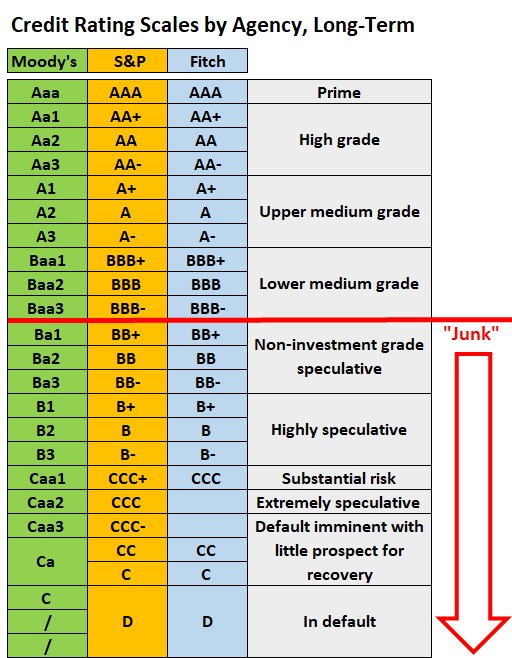

Credit ratings in Debt Mutual Funds are crucial for evaluating the risk linked to the bonds and debt instruments held within the fund. These ratings, assigned by agencies such as CRISIL, ICRA, and CARE in India, reflect the creditworthiness of the issuer, whether it’s a corporation or a government entity. The ratings typically range from AAA (indicating minimal risk) to D (indicating default risk).

A company’s performance can lead to upgrades or downgrades in its credit ratings. Debt mutual funds share the ratings of bonds in their portfolios each month, enabling investors to evaluate the associated credit risk. Bonds with higher ratings, like AAA, are considered safer but provide lower returns, while lower-rated bonds, such as BBB or below, carry greater risks but may offer higher returns to compensate for the increased default risk. Bonds with an SOV credit rating carry no credit risk and are issued by the Government, indicating the highest safety rating. For example, Gilt Funds invest solely in SOV-rated securities, and Corporate Bond Funds predominantly hold AAA-rated bonds, making them a suitable choice for conservative investors seeking safety.

Understanding credit ratings is essential for evaluating the level of risk in debt mutual funds. These ratings influence the stability of your investments, especially for risk-averse investors or those seeking consistent income. Given the complexities involved, consulting an AMFI-registered mutual fund distributor or advisor can help you assess credit quality in line with your risk tolerance, investment horizon, and financial goals—whether it’s retirement planning, emergency fund preparation, or long-term wealth creation. Expert guidance ensures you make informed, goal-aligned decisions for lasting financial success.