WHAT WOULD HAPPEN IF?

Risk management is the process of planning for “what if” scenarios that no one wants to occur. What if I get sick and am unable to work? What if I’m named in a lawsuit? What if I pass away before I’m supposed to? These unfortunate events may have an impact on your family’s financial stability.

It will quickly put aside retirement, college funding, home buying, and what if anyone else relies on your salary and would be unable to pay their bills without your assistance, such as parents of small children, children who financially support their parents, spouses, or other family members.

What lessons has the epidemic taught people all over the world?

1. Things are easily flipped upside down.

2. Take care of your health and safety.

Unexpected events and income insecurity during the virus outbreak prompted people to invest wisely to avoid financial insecurity. Although it is hoped that none of these situations will occur again, there is no guarantee that they will not, so planning should be made to protect your financial security.

The type and depth of risk management planning, like other aspects of wealth planning, is determined by your current position.

JUST DO IT….

For Peace of Mind-

For Protection of your loved ones….

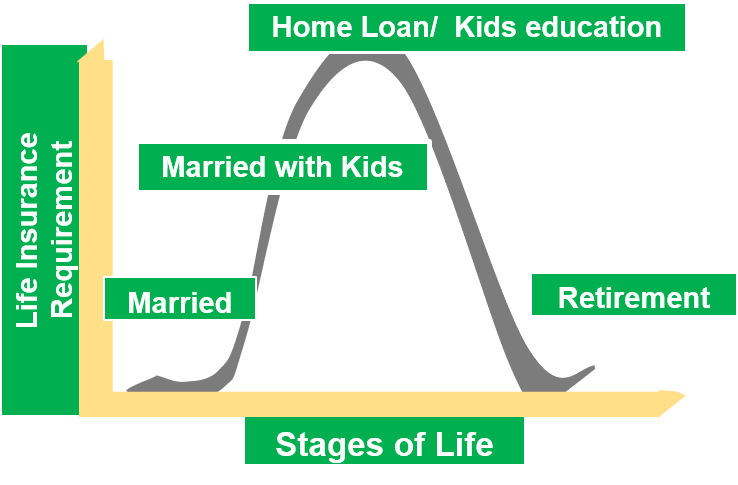

Although most of us understand the importance of insurance, purchasing insurance isn’t always our top priority. A life insurance policy provides financial security for your family. In exchange for a death benefit and life insurance against your life, you pay a certain amount of premium to the insurer. As a result, in the sad event of your death, your family will be financially compensated with the sum assured as well as any additional benefits (if any) provided by your life insurance policy.

You probably need more life insurance than you think. Using broad guidelines, such as 10 times your annual salary, may result in being significantly under or over insured.

Protect Your Wealth with Smart Risk Management Strategies.

Prepare yourself and your family for life’s worst “what if” scenarios by planning proactively. These risk management strategies can help you safeguard your livelihood, your family’s future, or your business.

Endowment insurance / ULIP Insurance has proven to have a high maturity value as a marketing tactic. When it comes to auto insurance, we don’t ask for maturity value. In fact, insurance is only intended to reimburse in the event that something goes wrong. As a result, any premium you pay is simply an outflow to protect you and your loved ones from life’s what-if scenarios.

Spend a small premium on term insurance to protect your future and invest the difference to grow your wealth!!

Once possible risks have been identified, your expert will recommend the most appropriate coverage for you and your family, such as life insurance, home insurance, personal accident insurance, and automobile insurance.