HEAVENLY UNIONS, EARTHLY CELEBRATIONS

Heavenly unions, earthly celebrations” – weddings are magical unions of hearts and families. We all dream big, but planning systematically is key. Are you ready to turn dreams into reality?

When your little one arrives, a significant challenge also enters the scene: securing their future financially. Amidst the joy and celebrations, it’s crucial to consider what lies ahead. Education and wedding plans are substantial investments for your child’s tomorrow. The wedding, in particular, comes with societal expectations. You desire nothing but the best for this special occasion.

Dream weddings are wonderful, but they come at a cost. How do you plan for this significant moment? Standard calculators might not cut it. Your child’s future hinges on three factors: the soaring wedding costs, societal expectations, and securing their well-being. Ready to dive in? Here’s how to ace your child’s future and their magical day.

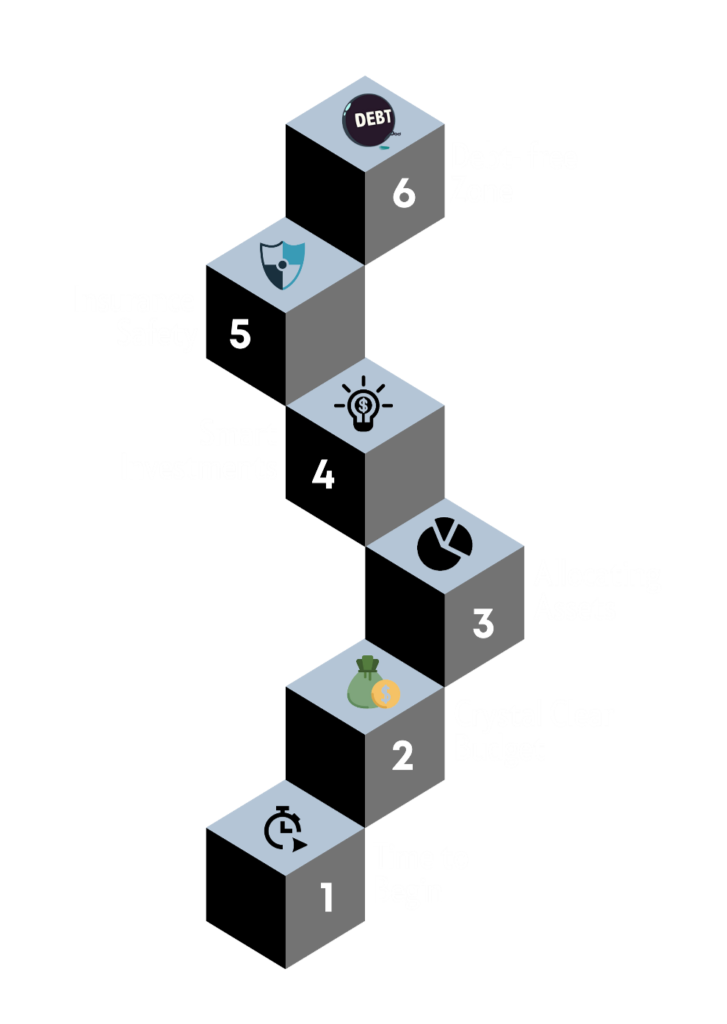

Steps To Plan For Your Child’s Wedding

Ready to plan the perfect wedding for your child? Here’s your recipe for success:

-

Time to Begin: Why wait? Start early and secure their dream wedding.

-

Crystal Clear Budget: Can you foresee wedding costs? Pin them down.

-

Allocating Assets: What suits you best? Find the perfect mix.

-

Smart Investments: Build the treasure chest wisely.

-

Insurance Safety: Are you optimally covered?

-

Debt-Free Zone: Let’s keep celebrations debt-free.

Follow these steps for a spectacular wedding journey!

Child’s Marriage Fund Expenses Calculation

Here are the details….

| Child Age | 7 Years |

| Fund Required at Age | 26 Years |

| Fund Required | ₹ 30,00,000 |

| Current Investment | Nil |

| Assumed Rate of Return (CI) | 0 % |

| Expected Inflation Rate | 8.00 % |

| Assumed Return (Scenario 1) | 12.00 % |

| Assumed Return (Scenario 2) | 7.00 % |

| Inflated Cost of Funds Required | ₹ 1,29,47,103 |

| Expected FV of Current Investment | NA |

| Balance Fund Required | ₹ 1,29,47,103 |

How much money do you need to save Monthly or lumpsum to fund your child’s marriage?

| Investment Option | Option 1 @ 12.00 % | Option 2 @ 7.00 % |

| Monthly SIP Till Age 26 | ₹ 15,986 | ₹ 27,821 |

| Monthly SIP For 5 Years | ₹ 32,665 | ₹ 70,129 |

| Monthly SIP For 10 Years | ₹ 20,840 | ₹ 40,939 |

| Lumpsum Investment | ₹ 15,03,246 | ₹ 35,79,982 |

Illustration for education purpose only. Option 1 & 2 are returns in CAGR