All About SIP Investment

A Systematic Investment Plan (SIP) is one of the easiest and most effective ways to invest in Mutual Funds. It allows you to invest a fixed amount regularly, whether monthly, quarterly, or yearly—rather than making a one-time lump sum investment. This approach helps build financial discipline and enables wealth creation over time.

One of the biggest advantages of SIP investments is that you don’t need to worry about market timing. By investing at regular intervals, you average out market fluctuations, reducing the risk of volatility. You can start an SIP with as little as ₹500 per month, making it accessible for everyone. The key benefit is compounding, where small investments grow into a substantial corpus over time.

SIPs are particularly suitable for long-term wealth creation, making them ideal for retirement planning, education funds, or achieving life goals. The process is simple—choose a mutual fund scheme, set your investment amount, and let the automated deductions handle the rest.

Systematic Investment Plan (SIP): The Smart Way to Grow Your Wealth

A Systematic Investment Plan (SIP) is a disciplined and effective way to invest in mutual funds. Instead of a lump sum, you invest a fixed amount regularly—monthly, quarterly, or annually. This makes investing affordable, minimizes risks, and helps build wealth steadily over time. SIPs also allow flexibility, meaning you can increase, decrease, or pause contributions based on your financial needs.

How Does Systematic Investment Plan (SIP): Work?

1. Choose a Mutual Fund – Select a scheme based on your financial goals, risk appetite, and investment objectives.

2. Set Your Investment Amount & Frequency – Decide how much to invest, starting as low as ₹500 per month.

3. Automated Deduction – The chosen amount is automatically deducted from your bank account and invested in the mutual fund on a fixed date.

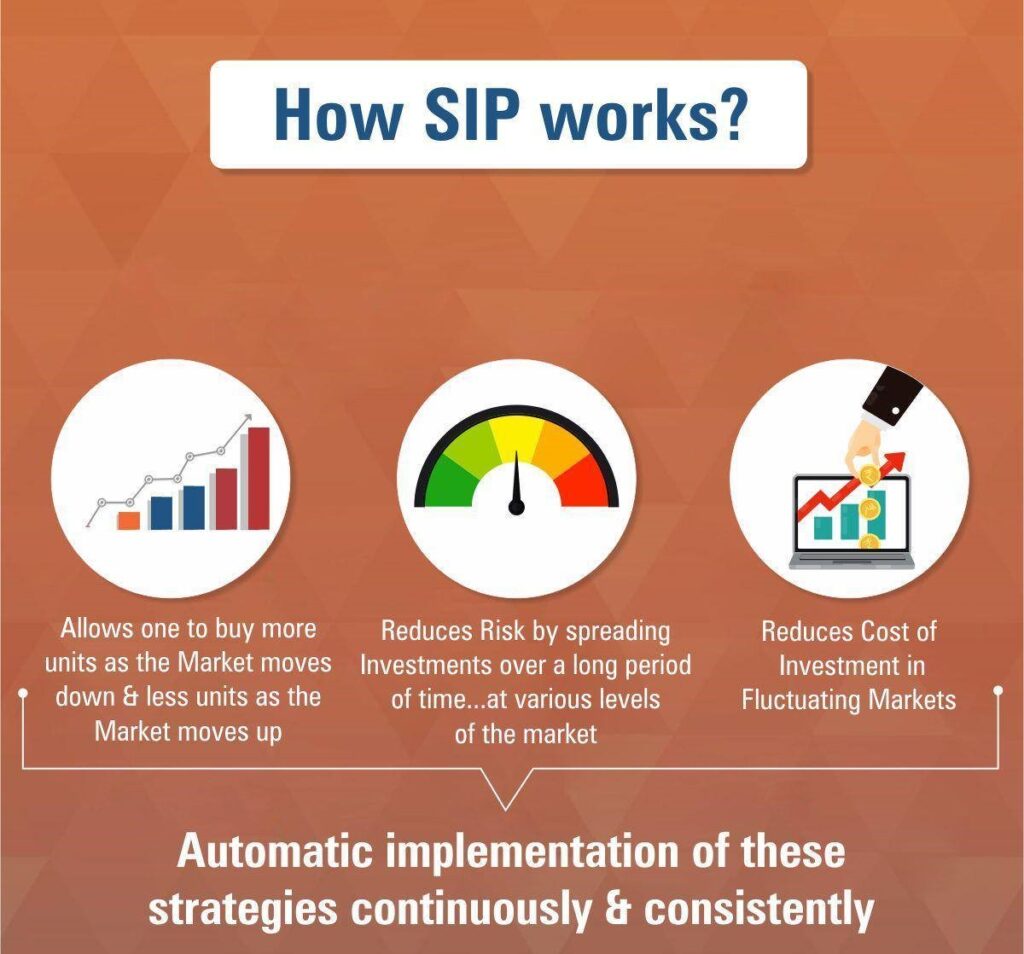

4. Buying Units at NAV – Your investment buys units based on the Net Asset Value (NAV) at that time. Since NAV fluctuates, you get more units when it’s low, and when it’s high, you get fewer units. This is called Rupee Cost Averaging, which helps lower the average cost per unit over time.

5. Accumulation & Compounding Growth – As you continue investing, you accumulate more units. Over time, your returns generate additional returns, leading to exponential growth through compounding.

Systematic Investment Plan (SIP): Simplified: How Your Investment Grows

To understand the power of SIP, let’s take a simple example:

Imagine you start a SIP of ₹10,000 per month in a mutual fund for one year. In the first month, if the NAV (Net Asset Value) is ₹20, you buy 500 units (₹10,000 ÷ ₹20 = 500 units).

Next month, if the NAV rises to ₹25, you get 400 units (₹10,000 ÷ ₹25 = 400 units). If it drops to ₹16 in another month, you buy 625 units. Every month, your ₹10,000 buys units at the prevailing NAV.

By the end of 12 months, your total investment is ₹1,20,000 (₹10,000 × 12 months). Due to rupee cost averaging, you buy more units when prices are low and fewer when they are high, balancing the overall cost.

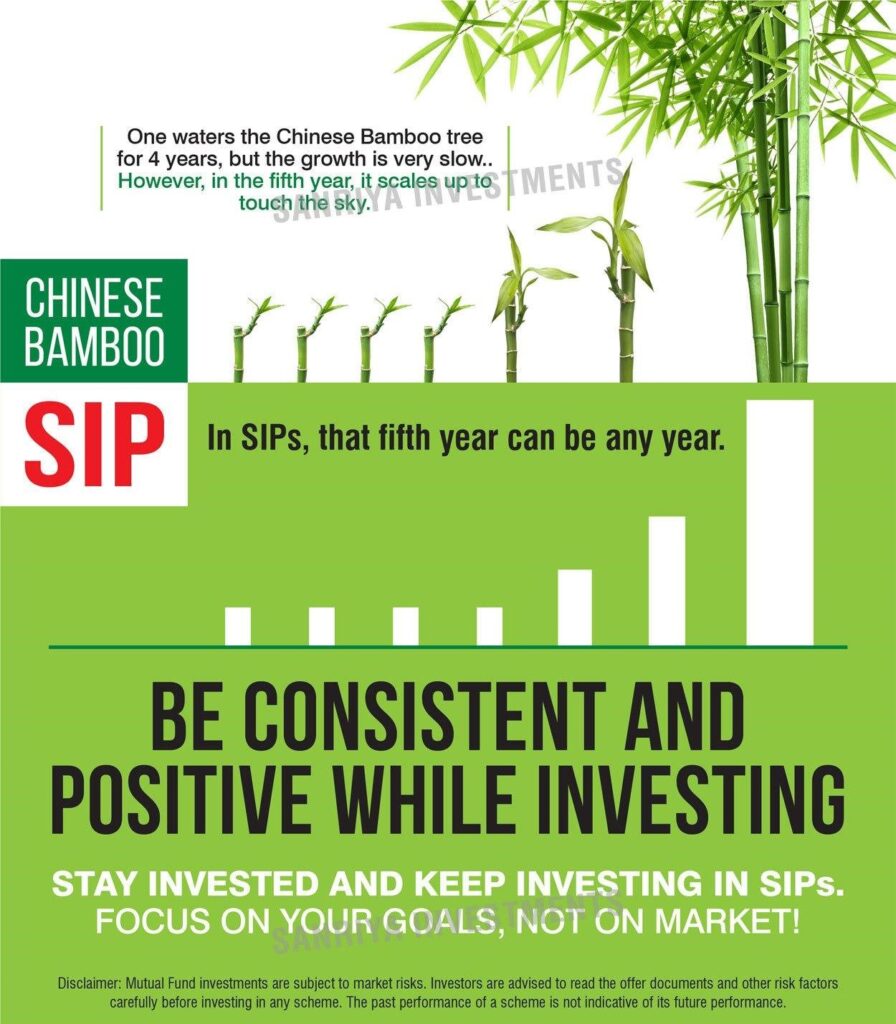

This disciplined approach reduces market risk and helps in long-term wealth creation. Start early, invest consistently, and let SIPs work for your financial future!

Why Choose SIP (Systematic Investment Plan)?

✅ Encourages financial discipline

✅ Minimizes market timing risks

✅ Leverages compounding for long-term growth

✅ Flexible—modify or pause contributions if needed

✅ Ideal for wealth creation over time

Start early, stay consistent, and let SIPs work for your financial success!

Types of SIPs: Choose the Right Investment Strategy for You

A Systematic Investment Plan (SIP) is a smart and disciplined way to invest in mutual funds, but did you know there are different types of SIPs to suit various financial needs? Whether you want flexibility, automatic increments, or long-term investing, there’s an SIP option for you.

1. Regular SIP: This is the most common SIP type, where you invest a fixed amount at regular intervals—monthly, quarterly, or yearly. It helps you stay disciplined and benefit from rupee cost averaging and compounding growth over time.

2. Top-up SIP (Step-up SIP): A top-up SIP allows you to increase your investment periodically, such as every year. For example, if you start with ₹5,000 per month and increase it by 10% annually, your investment grows with your income, helping you maximize returns.

3. Flexible SIP: With a Flexible SIP, you can adjust the investment amount based on your financial situation. If you have surplus funds, you can invest more; if finances are tight, you can reduce your SIP amount. This is ideal for those with variable income.

4. Perpetual SIP: Unlike traditional SIPs that run for 1, 5, or 10 years, a Perpetual SIP has no end date. You continue investing indefinitely until you stop, making it ideal for long-term wealth creation.

5. Trigger SIP: A Trigger SIP lets you invest based on specific market conditions, such as when the NAV falls, a stock index reaches a certain level, or a particular event occurs. This SIP is suited for experienced investors who understand market trends.

6. Multi SIP: With a Multi SIP, you can invest in multiple mutual funds through a single SIP, making it easier to diversify your portfolio. For example, instead of investing ₹5,000 in one scheme, you can split it among four funds.

7. SIP with Insurance: This type of SIP combines mutual fund investments with life insurance. Along with growing your wealth, you get an insurance cover. Your nominee will receive a lump sum payout if anything happens to you.

Understanding these SIP types will help you choose the best strategy based on your goals, income, and risk tolerance. Start investing today and take a step toward financial freedom!

Advantages of SIP: Why It’s the Best Way to Invest

A Systematic Investment Plan (SIP) is a simple and effective way to build wealth over time. It offers multiple benefits, making it one of the most preferred investment options for both beginners and seasoned investors.

1. Financial Discipline: SIPs encourage regular investing, helping you build a habit of saving. Since the investment amount is auto-debited, you stay consistent without worrying about making deposits.

2. Long-Term Wealth Creation: SIPs are ideal for achieving financial goals like retirement, education, or house purchase. Since they are professionally managed, you don’t need to track the market daily.

3. Power of Compounding: Your returns get reinvested, leading to compounding growth over time. For example, if you invest ₹5,000 per month for 10 years at a 12% annual return, your total investment of ₹6 lakh can grow to ₹11.61 lakh due to compounding.

4. Rupee Cost Averaging: SIP helps reduce market risk by averaging out the cost of investment.

When the market is low, you buy more units.

When the market is high, you buy fewer units.

This balances your overall purchase cost and eliminates the need to time the market.

5. Convenient & Hassle-Free: SIPs are automated, requiring minimal effort. Once set up, your investments continue without manual intervention. You can start, stop, or modify them anytime.

6. Affordable and Flexible: With SIPs, you can start investing with as little as ₹500 per month. You also have the flexibility to increase, decrease, or pause your SIP based on your financial situation.

7. Reduces Emotional Investing: Market fluctuations often lead investors to make impulsive decisions. SIPs keep you focused on long-term goals, reducing emotional reactions to short-term market movements.

Start Early, Stay Consistent, and Watch Your Wealth Grow! 🚀

Key Factors to Consider Before Starting an SIP

A Systematic Investment Plan (SIP) is a smart way to invest in mutual funds, but before you start, it’s essential to consider a few key factors. Proper planning ensures that your investment aligns with your financial goals and risk tolerance.

1. Define Your Financial Goals: Decide what you want to achieve with your SIP—wealth creation, retirement planning, buying a house, or funding education. Your goals will help determine the type of mutual funds you should invest in.

2. Assess Your Risk Tolerance: Every investor has a different risk appetite. Equity funds may be suitable if you are comfortable with high returns and higher risk. Hybrid funds are a good option for moderate risk, while debt funds are ideal for those seeking stability and lower risk.

3. Choose the Right Mutual Fund: Research and select a mutual fund that matches your objectives. Look at the fund’s track record, expense ratio, past performance, and fund manager expertise. Avoid funds with high costs that could reduce your overall returns.

4. Determine Your SIP Amount and Frequency: Choose an investment amount that fits your budget and long-term financial plan. SIPs can be monthly, quarterly, or weekly, so pick a schedule that aligns with your cash flow.

5. Understand Tax Implications: Different mutual fund types have different tax treatments. Equity Mutual Funds have a 12.5% tax on long-term capital gains above ₹1.25 lakh, while Debt Mutual Funds are taxed based on your income slab. Knowing these details helps in better tax planning.

Considering these factors, you can maximize returns, reduce risks, and achieve your financial goals efficiently. Start early, stay consistent, and watch your money grow! 🚀

How to Maximize SIP Returns and Choose the Right SIP Advisor/ MFD/ RIA

Want to make the most of your SIP investments? Here’s a simple guide to help you grow your wealth effectively and choose the Best SIP Advisor/ MFD / RIA to guide you:

Maximizing SIP Returns

Start Early: The sooner you start, the more time your money has to grow through compounding. For example, investing ₹5,000 monthly at 12% for 20 years can grow to ₹49.9 lakhs, but starting 10 years earlier could grow to ₹1.98 crores!

1. Invest Regularly: Consistent monthly contributions help you benefit from rupee cost averaging, reducing the impact of market ups and downs.

2. Diversify Your Portfolio: Spread your investments across different mutual fund categories (like equity, debt, or hybrid) to minimize risk and enhance returns.

3. Set Clear Goals: Define your financial objectives—buying a house, saving for retirement, or funding education—and choose SIPs that align with these goals.

4. Monitor and Adjust: Regularly review your SIP performance and make adjustments if needed to stay on track.

5. Stay Invested Long-Term: Avoid withdrawing early. Staying invested long-term helps you ride out market volatility and maximize compounding benefits.

6. Increase Contributions Gradually: As your income grows, consider increasing your SIP amount to accelerate wealth creation.

Example:

Imagine you’re saving for your child’s education in 15 years. A good SIP advisor can help you choose the right funds, monitor performance, and adjust your strategy. Meanwhile, starting early and investing ₹10,000 monthly at 12% could grow your investment to ₹50 lakhs by the time your child is ready for college!

By combining smart SIP strategies with the right advisor, you can confidently achieve your financial goals. Start today and watch your wealth grow!

Choosing the Right SIP Advisor/ MFD/ RIA

• Understand Your Goals: A good advisor / MFD / RIA takes the time to understand your financial goals, risk tolerance, and preferences.

• Personalized Approach: Opt for advisors / MFD / RIA who offer tailored investment strategies based on your unique needs.

• Experience & Qualifications: Choose someone with relevant experience and professional certifications.

• Certifications: Ensure they are certified by reputable regulatory bodies like SEBI or AMFI.

• Read Reviews: Seek recommendations from trusted sources and check client reviews for credibility.

• Ongoing Support: Choose someone who provides comprehensive support and prioritizes your financial well-being.

• Check Track Record: Look for an advisor / Mutual Fund Distributor / Registered Investment Advisor with a proven history of expertise and integrity in investment services.

Start simplifying your journey today.

Start your Best SIP investment

At Sanriya Finvest, we are committed to making your investment journey smooth and fulfilling. We offer Systematic Investment Plans (SIPs) across all Asset Management Companies (AMCs) in India. SIPs provide a disciplined and effective way to invest in mutual funds, helping you build long-term wealth with ease.

You can conveniently start your SIP investment with the following AMCs through us:

✅ Aditya Birla Sun Life Mutual Fund SIP Plan

✅ Angel One Mutual Fund SIP Plan

✅ Axis Mutual Fund SIP Plan

✅ Bajaj Finserv Mutual Fund SIP Plan

✅ Bandhan Mutual Fund SIP Plan

✅ Bank of India Mutual Fund SIP Plan

✅ Baroda BNP Paribas Mutual Fund SIP Plan

✅ Canara Robeco Mutual Fund SIP Plan

✅ DSP Mutual Fund SIP Plan

✅ Edelweiss Mutual Fund SIP Plan

✅ Franklin Templeton Mutual Fund SIP Plan

✅ Groww Mutual Fund SIP Plan

✅ HDFC Mutual Fund SIP Plan

✅ Helios Mutual Fund SIP Plan

✅ HSBC Mutual Fund SIP Plan

✅ ICICI Prudential Mutual Fund SIP Plan

✅ IL&FS Mutual Fund (IDF) SIP Plan

✅ Invesco Mutual Fund SIP Plan

✅ ITI Mutual Fund SIP Plan

✅ JM Financial Mutual Fund SIP Plan

✅ Kotak Mahindra Mutual Fund SIP Plan

✅ LIC Mutual Fund SIP Plan

✅ Mahindra Manulife Mutual Fund SIP Plan

✅ Mirae Asset Mutual Fund SIP Plan

✅ Motilal Oswal Mutual Fund SIP Plan

✅ Navi Mutual Fund SIP Plan

✅ Nippon India Mutual Fund SIP Plan

✅ NJ Mutual Fund SIP Plan

✅ Old Bridge Mutual Fund SIP Plan

✅ PGIM India Mutual Fund SIP Plan

✅ PPFAS Mutual Fund SIP Plan

✅ quant Mutual Fund SIP Plan

✅ Quantum Mutual Fund SIP Plan

✅ Samco Mutual Fund SIP Plan

✅ SBI Mutual Fund SIP Plan

✅ Shriram Mutual Fund SIP Plan

✅ Sundaram Mutual Fund SIP Plan

✅ Tata Mutual Fund SIP Plan

✅ Taurus Mutual Fund SIP Plan

✅ Trust Mutual Fund SIP Plan

✅ Unifi Mutual Fund SIP Plan

✅ Union Mutual Fund SIP Plan

✅ UTI Mutual Fund SIP Plan

✅ WhiteOak Capital Mutual Fund SIP Plan

✅ Zerodha Mutual Fund SIP Plan

✅ 360 ONE Mutual Fund (Formerly Known as IIFL Mutual Fund) SIP Plan

Frequently Asked Questions (FAQs) About SIP

Rupee Cost Averaging – Helps reduce the impact of market fluctuations.

Flexibility – You can increase, decrease, or pause your SIP.

Convenience – Auto-debits ensure hassle-free investing.

Higher Returns – SIPs often offer better returns than FDs and RDs.

No, SIP is just a method of investing in mutual funds. It allows you to invest in small amounts regularly instead of a one-time investment.

SIP returns vary based on the fund type. A debt fund SIP may offer 4-6% annual returns, while equity SIPs may yield higher returns over the long term.

A fixed amount is auto-debited from your bank account.

The money buys mutual fund units at the prevailing NAV.

Over time, compounding and rupee cost averaging help grow your investment.

Choosing a mutual fund platform (like Sanriya Finvest).

Completing KYC (upload PAN, ID proof, and address proof).

Selecting a fund and SIP amount.

Linking your bank account for auto-debits.

If you invest ₹20,000 per month in an SIP for 20 years at an expected return of 12% per annum, your total investment of ₹48 lakh may grow to approximately ₹1.99 crore due to the power of compounding.

Mutual fund provider’s website or app.

Sanriya Finvest investment portal.

Regular statements are sent to your email.

Do you still have questions? Contact Sanriya Finvest today and start your SIP journey!

A Systematic Investment Plan (SIP) helps you achieve various financial goals by enabling disciplined, regular investments. Here’s how SIP can support different life objectives:

Short-Term Goals (1-5 Years)

✔ Emergency Fund – Build a safety net for unexpected expenses.

✔ Vacation Fund – Save systematically for domestic or international trips.

✔ Lifestyle & Gadgets – Plan for purchases like smartphones, laptops, or a new vehicle.

Medium-Term Goals (5-10 Years)

✔ Buying a Home – Accumulate funds for a down payment or full purchase.

✔ Higher Education – Secure funds for your child’s or your own education.

✔ Starting a Business – Build capital for launching a startup or side venture.

Long-Term Goals (10+ Years)

✔ Wealth Creation – Grow your investments for financial freedom.

✔ Retirement Planning – Ensure a stress-free and independent retirement.

✔ Child’s Future – Plan ahead for education and marriage expenses.

SIP aligns your investments with specific goals, making financial planning easier. Need help designing a goal-based SIP strategy? 😊

SIP for Retirement, SIP for Child’s Education, SIP for Child’s Marriage, SIP for Wealth Creation, SIP for Business Startup, SIP for Home Purchase, SIP for Car Purchase, SIP for Travel, SIP for Emergency Fund, SIP for Higher Education, SIP Advisor Pune, SIP MFD Pune, SIP RIA Pune, SIP Services Pune, SIP Consultant Pune, SIP Broker Pune

Looking to deepen your knowledge of SIP? Explore our valuable resources for insights on benefits, strategies, and smart investment approaches. Learn how to make the most of your investments with expert tips and guidance. Stay informed and invest wisely!

1. What is a Step-Up SIP or Top-Up SIP?

2. How Do We Calculate SIP Returns?

3. What’s the Difference Between SIP, Flexi SIP, and VIP?

4. What Does a Perpetual SIP Mean?

5. What’s the Difference Between SIP and Recurring Deposit?

6. What’s the Best Day to Start an SIP in Mutual Funds?

7. How Does Tax Work for SIP, STP, and SWP?

8. What is the difference between SIP and lump sum investment?

9. Why is SIP a Great Way to Invest in Mutual Funds?

10. What is a SIP (Systematic Investment Plan)?

11. What Risks Come with SIP Investments? Can You Lose Money with SIP?