All About Systematic Transfer Plan (STP)

A Systematic Transfer Plan (STP) is an investment strategy that enables investors to move funds systematically from one mutual fund scheme to another within the same Fund House or Asset Management Company (AMC). This process helps investors manage risk, optimize returns, and maintain a disciplined investment approach.

What is a Systematic Transfer Plan (STP) in Mutual Funds?

A STP is a process that allows investors to transfer a fixed amount or units from one mutual fund scheme to another within the same Asset Management Company (AMC) at regular intervals.

In an STP, investors first invest in one mutual fund scheme, known as the source scheme, and then systematically transfer funds to another scheme, known as the target scheme. This transfer happens at a predetermined frequency, such as weekly, monthly, or quarterly.

STP is typically used to move funds between different types of mutual fund schemes, such as from a debt fund to an equity fund or vice versa. However, it can only be done between schemes managed by the same AMC and not across different fund houses.

This process ensures that funds are gradually shifted from one scheme to another without manual intervention. STP is a structured approach to reallocating investments within a mutual fund house based on an investor’s financial strategy.

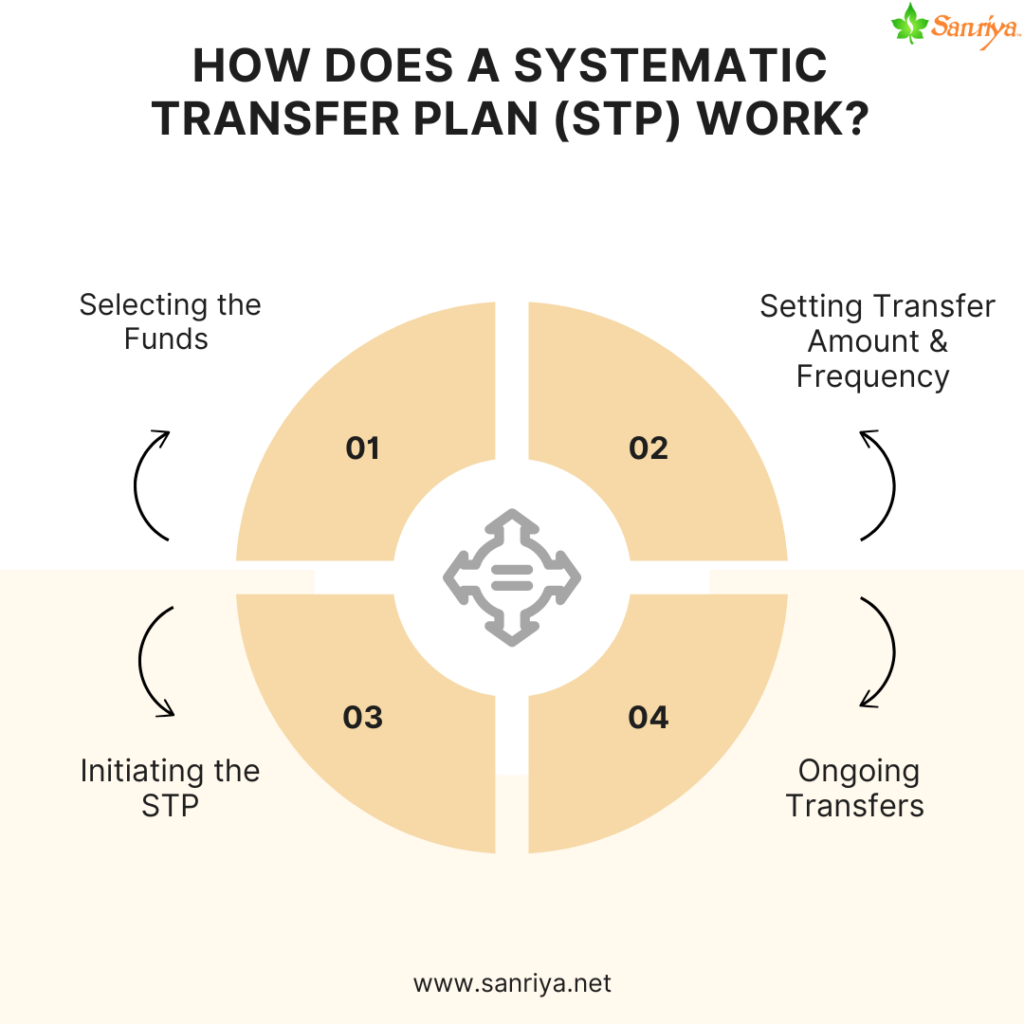

How Does a Systematic Transfer Plan (STP) Work?

A Systematic Transfer Plan (STP) allows investors to transfer a fixed amount or units from one mutual fund scheme to another within the same Asset Management Company (AMC) at regular intervals. This transfer typically occurs between a source fund (usually a debt or liquid fund) and a target fund (often an equity fund).

Steps Involved in STP:

1. Selecting the Funds : Investors choose a source scheme, where the initial lump sum is invested, and a target scheme, where funds will be transferred.

2. Setting Transfer Amount & Frequency : Investors specify how much money should be transferred and how often (weekly, monthly, or quarterly).

3. Initiating the STP : The mutual fund house automatically transfers the chosen amount from the source fund to the target fund on the specified dates.

4. Ongoing Transfers : The process continues until all the specified funds are transferred or the investor stops the STP.

During each transfer, units from the source fund are redeemed, and new units in the target fund are purchased, ensuring a structured approach to fund allocation. Investors can monitor their STP and adjust as needed based on market conditions and financial goals.

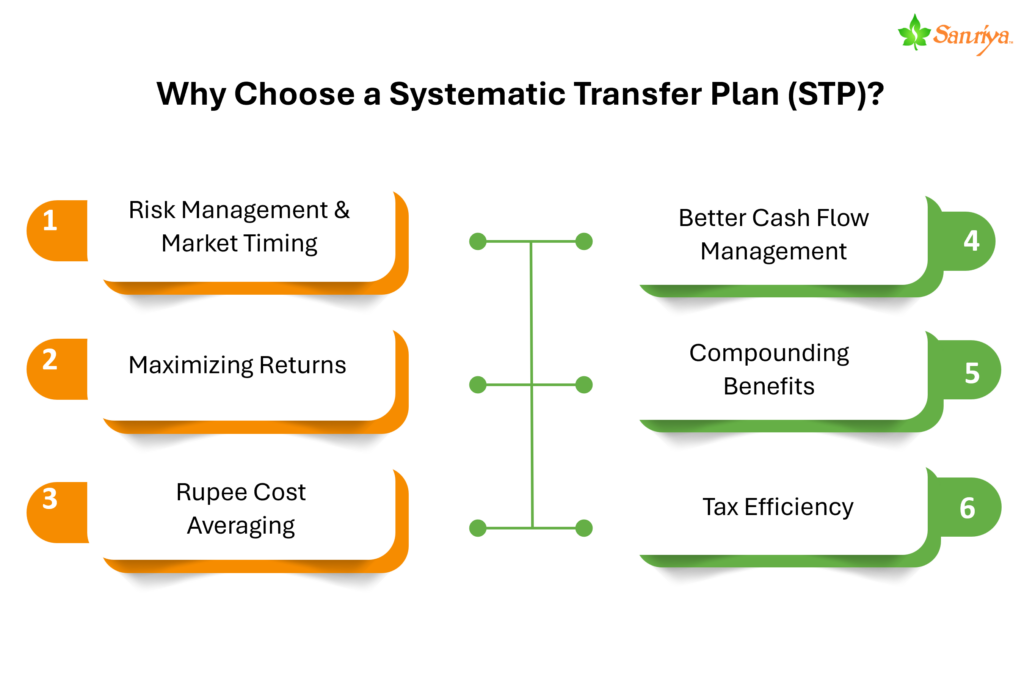

Why Choose a Systematic Transfer Plan (STP)?

✅ Better Cash Flow Management

STP provides a structured way to deploy funds over time, making it ideal for investors with a lump sum amount but who prefer to enter the market gradually.

✅ Compounding Benefits

While your money remains in the debt fund, it continues to earn returns until it is transferred, ensuring efficient capital utilization.

A Systematic Transfer Plan (STP) is a smart investment strategy that allows you to transfer funds systematically from one mutual fund scheme to another. It helps in managing risk, optimizing returns, and maintaining investment discipline. Here’s why STP could be the right choice for you:

✅ Risk Management & Market Timing

STP helps reduce market timing risk by spreading investments over time, ensuring a smoother entry into equity markets rather than investing a lump sum at once.

✅ Maximizing Returns

Instead of keeping funds idle in a low-return instrument, STP allows you to gradually shift money from a debt fund to an equity fund, optimizing returns.

✅ Rupee Cost Averaging

By investing at regular intervals, STP helps you average out the cost of investment, reducing the impact of market volatility.

✅ Tax Efficiency

STPs can be more tax-efficient than direct lump sum investments, especially when transitioning from liquid/debt funds to equity funds, as gains are spread over time.

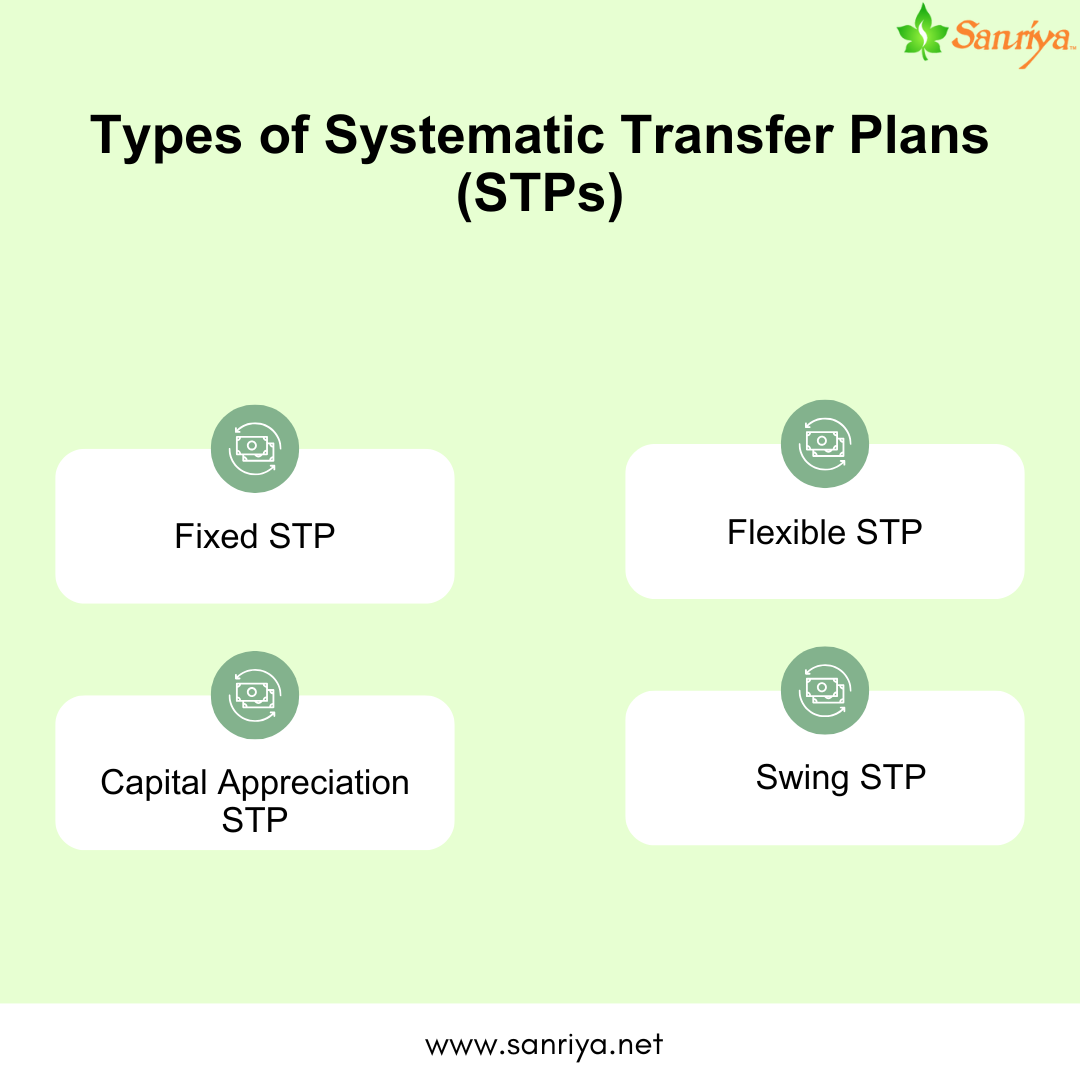

Types of Systematic Transfer Plans (STPs)

Investors can choose from four main types of Systematic Transfer Plans (STPs) based on their financial goals and market conditions.

1. Fixed STP : A Fixed STP transfers a predetermined amount from the source scheme to the target scheme at regular intervals, such as weekly, monthly, or quarterly. The transfer amount remains constant, providing a systematic and disciplined approach to investing.

2. Flexible STP : A Flexible STP allows investors to adjust the transfer amount based on market conditions or personal preferences. If the market performs well, an investor may transfer a larger amount from a debt to an equity fund. Conversely, during market downturns, they can reduce the transfer amount.

3. Capital Appreciation STP : In a Capital Appreciation STP, only the returns (profits) earned in the source scheme are transferred to the target scheme, while the original investment remains untouched. This allows investors to reinvest their gains into potentially higher-return funds while keeping their principal amount stable.

4. Swing STP : A Swing STP adjusts the transfer amount based on the difference between the intended value and the actual value of the investment. If the actual value exceeds the intended value, the excess amount is transferred back to the source fund, helping investors maintain a balanced portfolio.

Investors can select the type of STP that best suits their risk appetite, financial goals, and market outlook, ensuring a structured transition between mutual fund schemes.

Advantages / Benefits of Systematic Transfer Plan (STP)

A Systematic Transfer Plan (STP) offers multiple advantages that help investors manage risk, optimize returns, and maintain financial discipline.

1. Rupee Cost Averaging : By transferring a fixed amount at regular intervals, investors buy more units when prices are low and fewer units when prices are high. This helps reduce the average investment cost over time and minimizes the impact of market fluctuations.

2. Risk Management : Instead of investing a lump sum in a volatile market, STP gradually moves funds, reducing the risk of investing at a market peak and balancing portfolio risks.

3. Mitigating Market Timing Risk : Since investments are spread over time, STP eliminates the need to predict market movements, reducing exposure to sudden downturns.

4. Gradual Exposure to Equity : STP allows conservative investors to shift funds gradually from safer debt funds to equities, minimizing risk while benefiting from potential growth.

5. Higher Returns : By shifting to profitable ventures during market swings, STP helps investors gain from market fluctuations and maximize overall returns.

6. Portfolio Diversification : STP balances investments across asset classes, helping investors achieve an optimal mix of equity and debt for better risk-adjusted returns.

7. Tax Efficiency : Each transfer under STP is treated as a redemption, allowing investors to manage capital gains taxation more effectively compared to lump sum investments.

8. Stability in Volatile Markets : During market uncertainty, funds can be transferred to safer investments like debt or liquid funds, preserving capital while earning steady returns.

9. Flexibility and Customization : Investors can adjust transfer amounts and frequency based on financial goals and market conditions, ensuring a personalized investment approach.

10. Disciplined Investing : A structured and scheduled transfer process prevents emotional investment decisions, encouraging long-term wealth creation.

Using STP, investors can achieve a well-balanced investment strategy, ensuring steady growth while managing market risks effectively.

Who Should Opt / Consider a Systematic Transfer Plan (STP)?

A Systematic Transfer Plan (STP) is ideal for investors seeking a structured approach to managing risk, optimizing returns, and maintaining financial discipline. It is especially beneficial for:

✔ Lump Sum Investors : Those with a substantial amount to invest but prefer gradual exposure to equities instead of investing all at once.

✔ Risk-Conscious Investors : Individuals who want to minimize market volatility by transferring funds from debt to equity in a phased manner.

✔ Long-Term Investors : Those with a long investment horizon looking to gradually build equity exposure and benefit from long-term market growth.

✔ Diversification Seekers : Investors aiming to balance their portfolio by systematically allocating funds between debt and equity, reducing overall investment risk.

✔ Goal-Based Investors : Individuals planning for specific financial milestones, such as retirement, education, or home purchase, who want a disciplined transfer of funds.

✔ Investors with Limited Resources : Those who wish to participate in equity markets but prefer to invest gradually while managing risk.

✔ Disciplined Investors : People who might spend idle funds impulsively can use STP to ensure systematic investments instead of letting money sit in a savings account.

STP is a strategic investment tool that helps investors transition funds effectively, balancing growth potential and risk management for optimal financial outcomes.

Things to Consider Before Investing through a Systematic Transfer Plan (STP)

Before opting for a Systematic Transfer Plan (STP), investors should consider several factors to ensure it aligns with their financial goals and risk tolerance.

1. Investment Goals : Clearly define your financial objectives, whether wealth creation, risk management, or diversification, to choose the right funds for STP.

2. Market Conditions : STPs are helpful in mitigating market volatility, but investors should still monitor market trends to make informed decisions.

3. Risk Tolerance : Assess your risk appetite, select the source, and target funds accordingly. Conservative investors may prefer gradually shifting from liquid funds to equities.

4. Fund Performance : Analyze the historical performance of both the source and target funds to ensure they align with your investment strategy.

5. Cost Implications : Consider exit loads, entry loads, and other charges before investing, as they can impact overall returns. Some funds impose exit loads if transfers occur within a certain period.

6. Tax Considerations : Each transfer is a redemption and may attract capital gains tax. Short-term and long-term capital gains tax rates vary, so plan accordingly.

7. Discipline and Consistency : STPs work best when followed consistently. Exiting early may reduce its effectiveness and disrupt your investment strategy.

By considering these factors, investors can make informed decisions and maximize the benefits of STP while managing risks effectively.

Choosing the Right STP Advisor / MFD / RIA

✔ Understand Your Goals – A good advisor / MFD / RIA will assess your financial objectives, risk tolerance, and investment timeline before recommending an STP strategy.

✔ Personalized Approach – Work with an advisor / MFD / RIA who offers tailored investment strategies rather than a one-size-fits-all solution.

✔ Experience & Credentials – Choose someone with relevant experience and certifications from regulatory bodies like SEBI or AMFI.

✔ Research & Reviews – Seek recommendations from trusted sources, check client reviews, and ensure a strong track record of investment expertise.

✔ Ongoing Support & Monitoring – Your advisor / Mutual Fund Distributor / Registered Investment Advisor should provide regular performance updates, strategic adjustments, and ongoing financial guidance.

Example:

Imagine you have a lump sum of ₹12 lakh but want to gradually invest in equities while managing risk. Instead of investing the entire amount in one go, you park it in a liquid fund and initiate an STP to transfer ₹50,000 per month into an equity fund over two years.

• While in the liquid fund, your capital earns stable returns.

• Your gradual equity exposure reduces market risk and benefits from rupee cost averaging.

• By the end of two years, your entire investment is in equities, positioned for long-term growth.

• By combining a smart STP strategy with expert financial guidance, you can optimize returns, minimize risks, and achieve your financial goals efficiently.

A Systematic Transfer Plan (STP) is a powerful investment strategy that helps investors move funds systematically between mutual fund schemes, reducing risk and optimizing returns. It enables disciplined investing, portfolio rebalancing, and long-term wealth creation.

Whether you are a new investor looking to enter equity markets gradually or an experienced investor aiming to rebalance your portfolio, an STP can provide financial stability and growth while managing market fluctuations efficiently.

By understanding how STP works, its types, benefits, and key considerations, investors can make better financial decisions and build a well-diversified investment portfolio tailored to their long-term financial goals.

Seamless Systematic Transfer Plans (STPs) with Sanriya Finvest

At Sanriya Finvest, we are dedicated to making your investment transition smooth and strategic. We offer Systematic Transfer Plans (STPs) across all Asset Management Companies (AMCs) in India, enabling you to shift funds systematically from one mutual fund scheme to another.

You can conveniently set up an STP with the following AMCs through us:

✅ Aditya Birla Sun Life Mutual Fund STP Plan

✅ Angel One Mutual Fund STP Plan

✅ Axis Mutual Fund STP Plan

✅ Bajaj Finserv Mutual Fund STP Plan

✅ Bandhan Mutual Fund STP Plan

✅ Bank of India Mutual Fund STP Plan

✅ Baroda BNP Paribas Mutual Fund STP Plan

✅ Canara Robeco Mutual Fund STP Plan

✅ DSP Mutual Fund STP Plan

✅ Edelweiss Mutual Fund STP Plan

✅ Franklin Templeton Mutual Fund STP Plan

✅ Groww Mutual Fund STP Plan

✅ HDFC Mutual Fund STP Plan

✅ Helios Mutual Fund STP Plan

✅ HSBC Mutual Fund STP Plan

✅ ICICI Prudential Mutual Fund STP Plan

✅ IL&FS Mutual Fund (IDF) STP Plan

✅ Invesco Mutual Fund STP Plan

✅ ITI Mutual Fund STP Plan

✅ JM Financial Mutual Fund STP Plan

✅ Kotak Mahindra Mutual Fund STP Plan

✅ LIC Mutual Fund STP Plan

✅ Mahindra Manulife Mutual Fund STP Plan

✅ Mirae Asset Mutual Fund STP Plan

✅ Motilal Oswal Mutual Fund STP Plan

✅ Navi Mutual Fund STP Plan

✅ Nippon India Mutual Fund STP Plan

✅ NJ Mutual Fund STP Plan

✅ Old Bridge Mutual Fund STP Plan

✅ PGIM India Mutual Fund STP Plan

✅ PPFAS Mutual Fund STP Plan

✅ quant Mutual Fund STP Plan

✅ Quantum Mutual Fund STP Plan

✅ Samco Mutual Fund STP Plan

✅ SBI Mutual Fund STP Plan

✅ Shriram Mutual Fund STP Plan

✅ Sundaram Mutual Fund STP Plan

✅ Tata Mutual Fund STP Plan

✅ Taurus Mutual Fund STP Plan

✅ Trust Mutual Fund STP Plan

✅ Unifi Mutual Fund STP Plan

✅ Union Mutual Fund STP Plan

✅ UTI Mutual Fund STP Plan

✅ WhiteOak Capital Mutual Fund STP Plan

✅ Zerodha Mutual Fund STP Plan

✅ 360 ONE Mutual Fund (Formerly Known as IIFL Mutual Fund) STP Plan

Start Your STP Today!

Secure your financial future with a disciplined and structured investment approach. Contact Sanriya Finvest today to get started with your STP! 🚀

Frequently Asked Questions About Systematic Transfer Plan (STP)

Some fund houses allow investors to pause an STP and resume it later temporarily, but this varies by AMC. Check with your fund provider.

Yes, STP can transfer funds between different types of mutual fund schemes within the same AMC, including equity, debt, and hybrid funds.

STP allows investors to systematically move funds based on market conditions and financial goals, helping in goal-based investing, tax planning, and risk management.STP for Retirement, STP for Child’s Education, STP for Child’s Marriage, STP for Wealth Creation, STP for Business Startup, STP for Home Purchase, STP for Car Purchase, STP for Travel, STP for Emergency Fund, STP for Higher Education, STP Advisor Pune, STP MFD Pune, STP RIA Pune, STP Services Pune, STP Consultant Pune, STP Broker Pune

Looking to deepen your knowledge of STP? Explore our valuable resources for insights on benefits, strategies, and smart investment approaches. Learn how to make the most of your investments with expert tips and guidance. Stay informed and invest wisely!

1. How Does Tax Work for SIP, STP, and SWP?

2. What is STP? How Can It Help You in Investing?