Decoding Wealth Creation: Analysis on the Behaviour Gap in Investment Returns vs Investor Returns by Santosh Kedari CEO Sanriya Finvest Pvt Ltd.

Is wealth creation such a simple exercise? If so, we would have come across many successful investors. However, starting is simple, but sustaining it is tough, just like in relationships.

All an investor wants is to get the Best Fund. But even the best fund failed to give returns to investors.

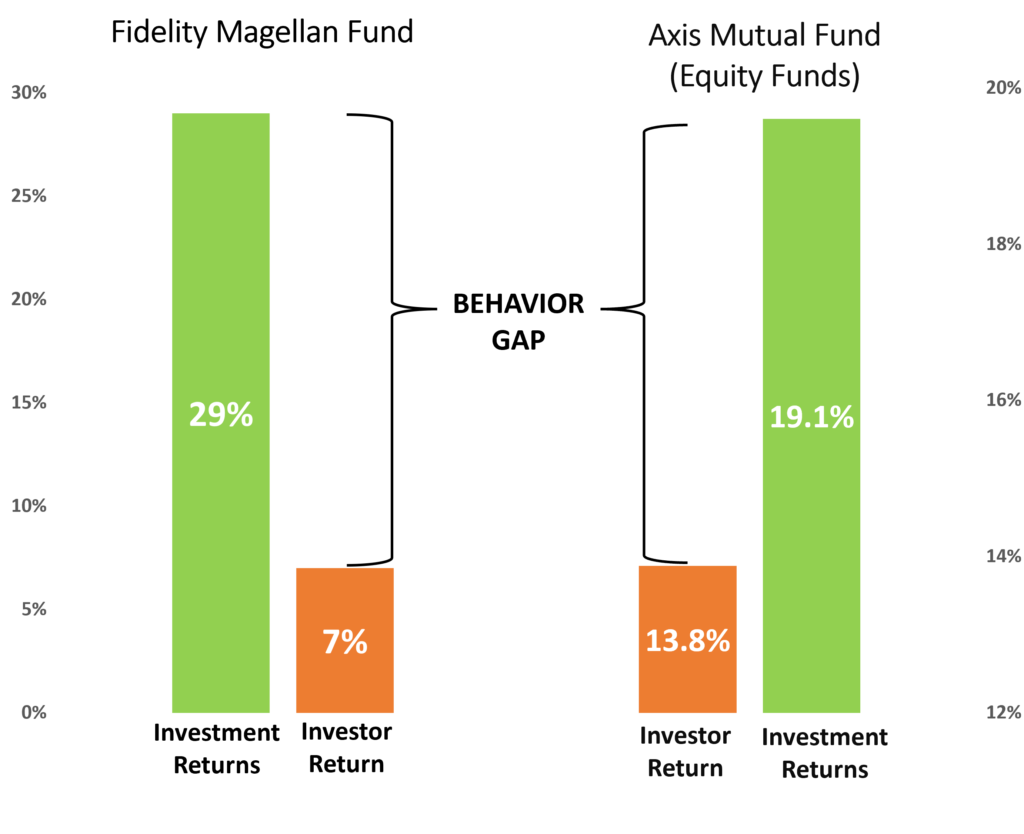

Peter Lynch, the famous fund manager, led the successful Fidelity Magellan Fund from 1977 to 1990. During that time, the fund achieved an incredible compound annual growth rate (CAGR) of 29%. However, investors in the fund only received 7% returns in the same period. In India, a 20-year study by Axis Mutual Fund (2003-2022) found that regular equity funds delivered a 19.1% CAGR, while investor returns were only 13.8% during this period.

What has caused the gap between fund and investor returns? Why does this happen?

It happens because of investors’ emotional and illogical behaviour, leading to unwise investment decisions, in a simple way doing dumb things with Investments, i.e., called a Behaviour Gap.

Common mistakes include:

- Investors trying to time the market,

- Overreacting to news,

- Chasing short-term performance, and

- Doing entry and exit at the wrong time or frequently, instead of being disciplined and sticking to their long-term plan.

It shows that investors are their own worst enemies when it comes to investing.

Lots of people wrongly think that investing is just about numbers, but in reality, it’s mostly about psychology. Unfortunately, this tends to lower long-term investment returns. It’s impossible to remove the certainty of uncertainty. Although we are aware that equity markets will fluctuate, the timing, duration, and magnitude remain uncertain.

Benjamin Graham’s wise words from his book, “The Intelligent Investor,” in 1929 still hold true today: “The Investor’s biggest enemy and worst problem is likely to be himself.”

In summary, successful wealth creation requires two things:

- Emotional discipline

- Consistent expert guidance.

To achieve long-term financial goals, it’s important to understand your emotions and avoid typical emotional mistakes. To address this, we formulate a financial roadmap, adhere to it, and bridge this gap.

Connect directly with Mr. Santosh Kedari on WhatsApp: Click here to message on WhatsApp.

Mr. Santosh Kedari CEO Sanriya Finvest Pvt.Ltd is a seasoned expert in the mutual fund arena and a Certified Financial Planner. He is committed towards bridging the Behaviour Gap in investments and offers tailored financial roadmaps for investors. For more information please visit, www.sanriya.net

Investment Returns vs Investors Returns > Behavioral Gap = Emotional and Illogical Investing Behavior with investments

#IntelligentInvesting #EmotionalFinance #WealthCreationWisdom #PsychologyOfInvesting #LongTermGrowth #InvestmentDiscipline #AvoidingInvestmentTraps #FinancialIntelligence #InvestingInsights #SmartInvestorMindset #bestfund #bestmutualfund #mutualfunds