What’s your Plan for Retirement?

Is Your Retirement Plan as Well Thought Out as Your Vacation? Retirement, often considered the longest vacation of our lives, should be a time filled with joy, comfort, and the freedom to pursue our passions

Like foreign countries, we do not have any social security to look after our retirement. All Private & Government sector employees would not have monthly pension after retirement in future.

Without proper retirement planning, life can be cruel and miserable. For day-to-day expenses, one will have to ask from their children or forced to work beyond their desired retirement age for money.

Let your retirement be a well-deserved period of joy, happiness, and financial security.

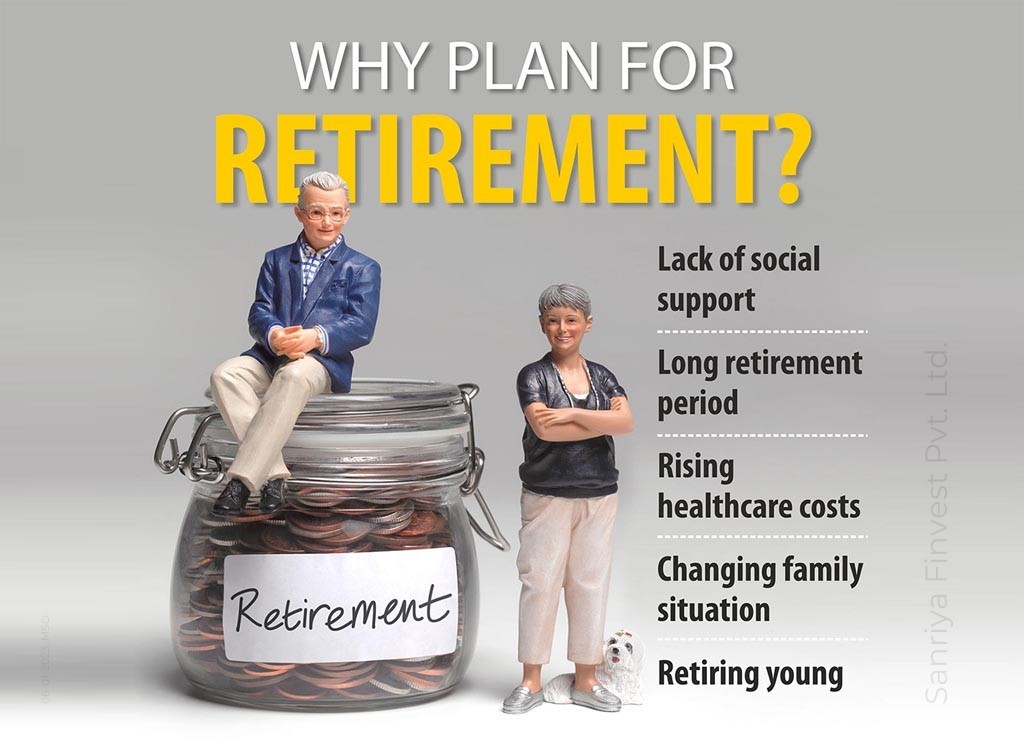

Why should you consider retirement planning?

You most likely know a lot of things in life. However, there are a few elements that might affect your capacity to retain financial stability when it comes to retirement planning.

Why you should plan your retirement because:-

□ You cannot work forever.

□ Increasing retirement years, living longer.. the average life expectancy is rising

□ Missing of a social retirement benefit. □ Lonely retirement due to nuclear families.

□ Healthcare cost increases with age, Higher complications, medical emergencies.

□ It is dangerous to rely solely on one source of income, such as a pension.

□ Do not depend on children. (Retire Like a Boss)

□ Contribute to the family even during retirement.

□ Your employment was terminated years early than expected. Retire on your terms.

□ Wish to keep your present standard of living once you retire.

□ Wish to have the security of a continuous income flow without a salary

□ Best time to fulfil life aspirations. (stress free life)

□ You cannot work forever.

Don’t take retirement planning for granted

Early retirement will not be as worrisome.

When you want to retire at 60, it’s terrific; being forced out of your work early isn’t. Sadly, over half of all current retirees are not doing so voluntarily. The majority were fired or forced to leave their employment, while a smaller proportion were compelled to quit work early to care for a sick or elderly parent or spouse. If you have to quit your job before your planned retirement age, having a retirement plan in place will put you in a much better situation.

Even though you may not have an adequate retirement corpus, having money set aside for retirement provides you more options and time to change your plans if you need to retire early. Working until you’re older not only gives your savings more time to grow, but it also reduces the number of retirement years you’ll need to support.

Do you want to depend on your kids when you grow old?

Do you know what “Sandwich Generation” is?

This is the term for a group of individuals who are supporting their children and one or both parents at the same time.

Around 40% of middle-aged individuals with children at home have at least one surviving family member who may require assistance; some are full-fledged sandwich generation members who financially support both parents and children.

Saving for all expenses includes part of comprehensive retirement plan. You won’t have to rely on your relatives to pay the bills / expenses when you know your bills are covered.

Running out of money during retirement is a real possibility for most people.

The average life expectancy has grown due to advances in medicine and health technology, and it is presently between 80 and 100 years.

Retirees who live longer lives may find themselves spending even more time in retirement with little money. If your retirement funds run out a decade or two into retirement, and you then face huge medical expenses, your retirement corpus will most likely not cover all of your needs.

If you run out of money while still having years to live in retirement, your golden years may not be as happy as you had thought.

So, far in advance of retirement, you should complete the projections that ensure your investments are on track to last the rest of your life..

Our goal is to help you live the life you’ve dreamed of and make your money last.

You retire from work, not life.

Your retirement years are a new chapter of your life in which you may give up a stressful work existence and focus on your family and interests. During this period, you can learn and find many new hobbies and passions.

Life after retirement is the start of an exciting phase that can only be welcomed if it has been planned for. If you are financially prepared, you can live this phase with joy and happiness like you’ve never lived before. And you may say and sing “Every thing is fine” every day of your retirement. Excellent news! People are living longer lives into their golden years. Bad news! People will have to pay for it.

NURTURING WEALTH, SO YOU CAN LIVE A LONGER, BETTER LIFE IN RETIREMENT

Retirement- Financially Independent

The lifestyle necessities and choices will aid in budgeting / spending. As a result, financial planning will support in the building of a retirement fund. You’ve worked hard to create a life for yourself and your family that is full of dreams, achievements, and happiness. As you approach or are in retirement, you may have fresh goals and aspirations in mind. You could desire to spend more time with your loved ones or travel around the world. You may also wish to fulfil obligations such as your child’s further education or wedding. With a retirement planning, you may fulfil your dreams while still retaining your financial freedom.

Make the most of your retired Life!

Financial security in retirement doesn’t just happen.

It takes planning and commitment and, yes, money.

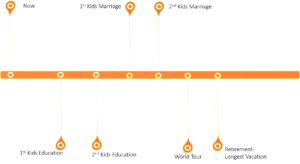

When to Plan?

We begin our careers when we are young, carefree, and full of enthusiasm. The concept of retirement seems so far away that the idea of saving for it seems crazy. Unfortunately, 70% of working professionals fall into this category. The other 30% have the upper hand in life and living, both in their prime years and in their golden years. Therefore, it is necessary to begin saving and investing early in life in order to reap the benefits in your retirement years.

Before you begin planning for retirement, consider the following questions:

□ When am I going to retire?

□ How long am I going to live?

□ What is my basic monthly expenditure?

□ What will the future cost of my expenses be?

□ Is my contingency corpus sufficient?

□ Should I budget for my health-care and medical expenses?

□ Is my insurance coverage adequate?

□ What do I have / own?

□ Is it possible to create cash inflows throughout my retirement?

□ What do I want to do in my retirement?

How to design a retirement roadmap?

Retirement planning isn’t rocket science. All that is required is to follow the instructions outlined below:

-

First, identify your lifestyle priorities and the financial requirements , compute your monthly budget, cash flows, tax paperwork, estate-planning documents, and insurance coverage.

-

Then, identify and work to reduce any risks that may stand in the way of a successful retirement.

-

It is up to you to decide whether you want to focus solely on short-term goals and objectives while avoiding the unavoidable retirement, or whether you want to begin working on your retirement plans today.

-

Define the investment period.

-

Calculate your current and projected future expenditures

-

Calculate inflation and interest rates before and after retirement.

-

Specify the asset allocation strategy

-

Start investing early.

Continue to save if you are currently doing so, whether for retirement or another goal. You are aware that conserving money is a rewarding habit. If you aren’t saving, now is the time to start. Start small if necessary, and gradually increase the amount you save each month. The sooner you begin saving, the longer your money has to grow . Make retirement investment as a top priority. Create a strategy, adhere to it, and set goals. It is never too early or too late to start investing.

Start simplifying your journey today. Avoid dipping into your retirement funds.

Beginning Retirement Planning

Let your retirement be a well-deserved period of joy, happiness, and financial security. The Retirement calculations will help you understand how much you need to grow your wealth before you retire and how to plan for it. Here’s an example to understand. Let’s say this table describes your scenario –

Current Age: 35 Years

Retirement Age: 60 Years

Life Expectancy: 85 Years

Current Monthly Expense: ₹ 1,00,000

Inflation: 7%

The graph below shows how your expenses could increase with inflation as you go through life.

Current Monthly Expense at Retirement age 60 will climb to : ₹ 5,42,743

At age 60 You need to accumulate a retirement fund / corpus to cover your retirement life till age 85 : ₹ 15,37,22,435

How much money do you need to save Monthly or Lumpsum to accumulate your retirement corpus.

Monthly SIP Till Age 60 : ₹ 90,308

Monthly SIP For 5 Years: ₹ 1,96,488

Monthly SIP For 10 Years: ₹ 1,25,357

Lumpsum Investment: ₹ 90,42,462

Illustration purpose only

A wise investor’s secrets….

Smart investors have a few strategies up their sleeves that can help them retire wealthy. Here are some suggestions to help you invest money wisely:

-

Begin as soon as possible. In fact, you should begin investing for retirement right away.

-

Diversify your investing portfolio.

-

Investment in mutual funds to take advantage of compounding.

-

Instead of splurging on holidays and impulse buys, save your bonuses.

-

Increase your investment and investment amounts each year in parallel with your pay raises.

-

Discuss your partner’s or spouse’s retirement plan and whether it makes sense to link both.

Avoiding Retirement Financial Blunders

-

Overspending

-

Inflation’s effect has been underestimated.

-

Underestimation of medical expenditures

-

Pensions Incomes are overestimated.

-

Retiring earlier than expected.

-

Failure to consolidate your retirement assets

-

Thinking you can work forever

-

underestimating retirement years

-

relying on children for financial aid

Plan your golden years with Sanriya Finvest’s Retirement Services!

Remember…Investing Matters!